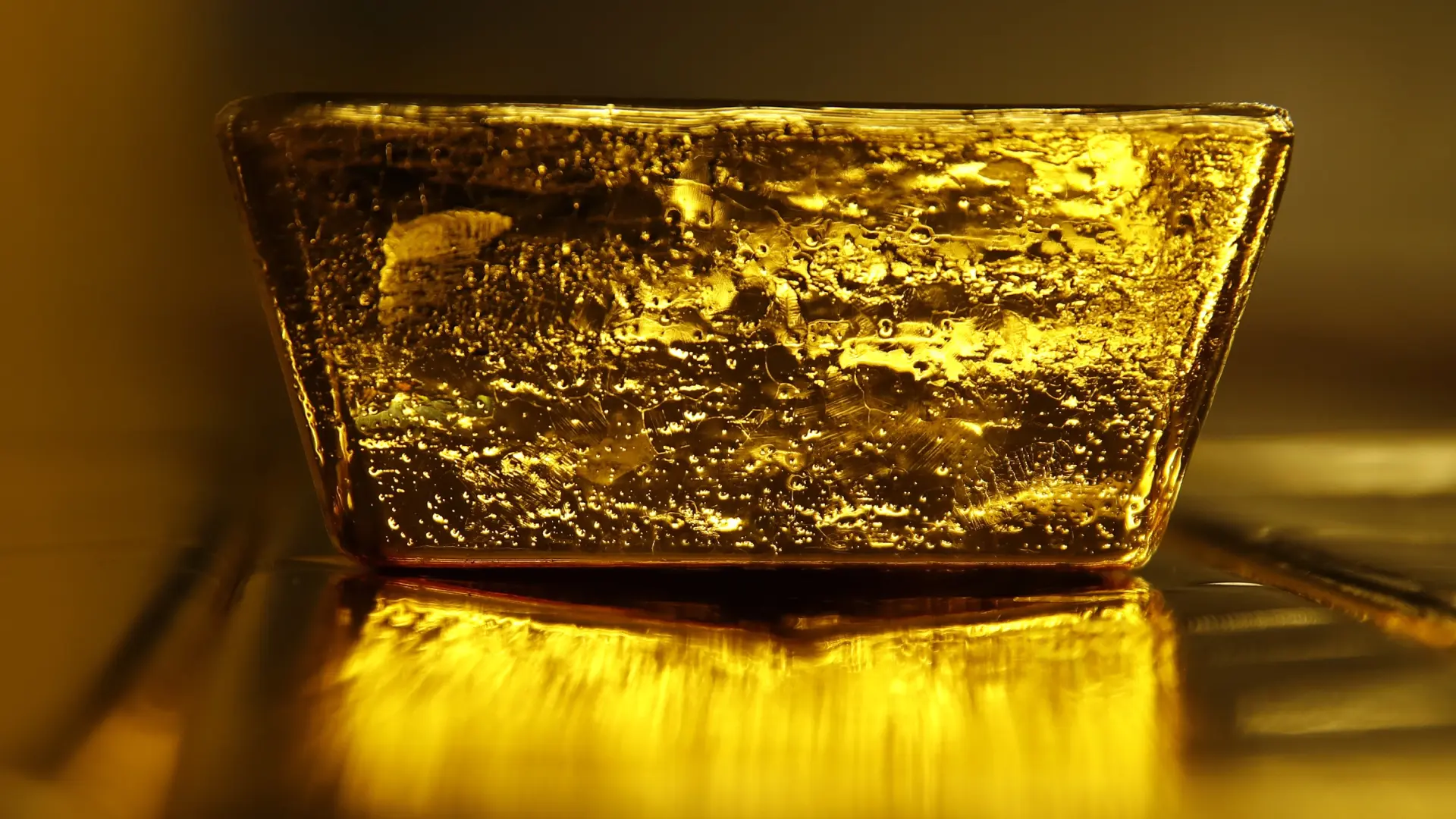

THE gold price The spot continued its rise this Wednesday, when it exceeded the threshold of $4,500 per ounce for the first time in its history, poised to close out its best year since 1979 for this safe haven asset, with a cumulative revaluation of more than 70% in 2025.

The prospects of further interest rate cuts in the United States and persistent geopolitical instability has once again driven up the price of this raw material in cash up to a maximum of $4,525.96with an increase of 0.9% compared to yesterday’s closing data. So, the price of an ounce of gold accumulates so far this year a rebound of 72.5%.

In addition to gold, the price of silver notably accelerated its rise this Wednesday with an increase of 2.3% compared to the previous session, until reaching a new record of $72,750 per ounce. In 2025, the price of silver will increase by 149%. In contrast, platinum futures rose 4.7% before opening in Europereaching an intraday high of $2,394.75. The metal’s revaluation so far this year is therefore around 163%.

The different uses given to the two metals also affect their price. Half of the demand for gold It comes from investments (bullion, coins and exchange-traded funds) and demand from central banks, while only a sixth of the money is intended for investment purposes. Gold also plays a larger role for jewelry (over 40%) than silver (over 20% if combined with silverware).

On the other hand, the industrial use of gold is rare (less than 10%), while most of the money is used in this sector (around 60%), with electrical and electronic applications as well as photovoltaic energy being the most important areas. Thus, the price of silver is more tied to the global economic cycle, making it more prone to corrections if the global economy slows down.

In addition to gold purchases by central banks, the prospect of a further rate cuts from the Fed in 2026especially after the November inflation data of 2.7% was much better than expected, lowers the price of the dollar against major currencies, making it cheaper for non-U.S. investors to buy gold.

The market sees in this metal a way to avoid sovereign debts and currencies and thus guard against growing budget deficitswhile massive purchases by central banks are also pushing up its price. From Goldman Sachs, they affirm that they will maintain the buying fever, pushed by the central banks.