The price of dollar Because it is stable, paying an interest rate in pesos is a better investment for savers, at least for now. Therefore, the dilemma arises as to whether it is appropriate to make one in the coming days traditional fixed term or a UVA fixed termThis is the one that adjusts inflation, a variable that has been increasing in recent months.

Specifically that INDEC I just published this Inflation was 2.5% monthly In November past, so investments that follow this indicator also appear attractive.

On the side of traditional retail term for individualsThis instrument is now available at leading banks, among others annual nominal interest rate (TNA) of around 22% for 30-day placements, which corresponds to the minimum reserve period that the financial system requires funds.

This way, in a month is earned with these types of deposits approx. 1.81%.

Instead a UVA fixed term, This is the deposit that adjusts its performance based on the Consumer Price Index (CPI). Hedging against inflation. The downside is that one is required Minimum stay of 90 days.

That means, The weights placed on them may not be removed for three monthsa very big and unpredictable time for Argentina.

Hence the UVA with a fixed term proposes the alternative “advance termination”. his constitution before the appointed time, provided 30 days of constancy have elapsed. In return for this benefit, you will face a penalty that you will receive Very low interest rate which is barely 10% of TNA. A figure that equates to an interest return of 0.8% every 30 days, a third of current monthly inflation.

Inflation last month and in December this year, according to economists’ forecasts, suggests that this indicator outweighs the interest rate. Although for them first months of 2026the predictions are that the The interest rate will be positive again against this indicator.

There is also another fundamental aspect for savers: The price of the dollar remains stableactually fell by almost 1% for the whole of December.

And the market also pays attention to how new replacement belt scheme, that the Central Bank will begin to apply from January, starting to adjust these references no longer by 1% monthly, but by the inflation of the two previous months (t-2), in this case by 2.5% in November, so that the monetary authority’s non-intervention ceiling would rise to around $1,560 by the end of next month.

According to business activity in the Matba-Rofex (A3) options and futures market, the wholesale dollar would be at $1,459.5 by the end of December and $1,494.5 by the end of January. That is, it is expected to be almost “stopped” later this month and rise by 2.4% during January.according to the negotiated values.

In short, the traditional fixed terms They would lose out to UVA’s fixed terms in the current month, but come January that equation could be reversed. That is, the saver’s question is what the profitability will be in the coming months with one or another deposit option.

Fixed term or dollar

On the one hand, current The fixed term is positioned as the most profitable alternative against the dollarat least in a short time.

“This month I would invest with a fixed term. “The demand for seasonal money makes the exchange rate stable, in addition to the sharp change in positive expectations after the election last October,” he summarizes. Fernando Beareconomist at Quantum, iProfessional.

For now, “the data is consistent with that In the first half of December, we assume that fixed conditions will protect purchasing power to some extent the savers in the first quarter of next year,” says Andres MendezDirector of AMF Economía.

He adds to this Andres SalinasEconomist and researcher at the Universidad La Matanza (Buenos Aires): “Inflation began to accelerate slightly, due, among other things, to the larger amount of money that came into circulation, so that the fixed term is becoming more and more established as a poor investment option.” As well “The key is diversification. We already know that those who were only in dollars and didn’t invest them really lost out last year.”.

For the economist Natalia MotylHe The government decided to keep the “ironed dollar” to indicate disinflation, so it is not advisable to bet on it today until February. Now we have to wait and see what happens with the debt maturities in January so that there is no additional uncertainty that puts pressure on the exchange rate, although I don’t see that happening.”

So that’s it The government also doesn’t want the price of the dollar to get out of controlso that there is no imbalance in controlled inflation, about 2% monthly. That is, the new banding scheme, which begins in 2026, requires all variables to follow the same line.

“The need to keep the exchange rate under control at historically low levels, as evidenced by the levels recorded over the last 20 years, forces a Monetary policy that encourages saving in pesos”Méndez thinks.

From January onwards, the traditional fixed-term contract would win again.

The traditional fixed term will once again be the winner (albeit narrowly) in January

Compared to next months with fixed dates, Both traditional and UVA can take into account market forecasts regarding expected inflation and interest rates.

“It will be increasingly attractive to position yourself in traditional certificates.” compared to those who are nominated in UVAs and whose benefits are limited to the extent that they want to receive the funds before their due date,” says Méndez iProfessional.

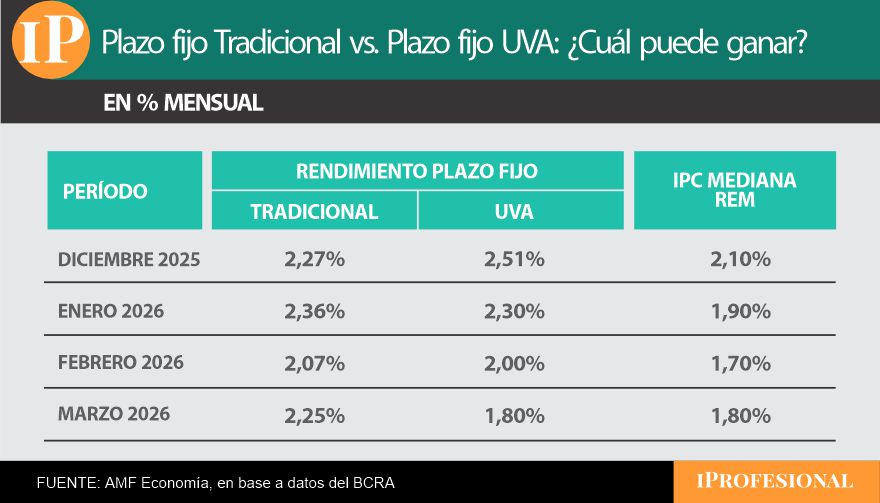

In it Month by month analysisAccording to economists’ forecasts, the… The traditional fixed term loses value to the UVA deposit in Decemberbut since January he has been a winner again.

It is that in the present DecemberIt is estimated that the With the traditional fixed term, the monthly income is 2.27%, while with the UVA fixed term, 2.5% is achieved..

Now stop it January is the samebecause it is projected that the Traditional fixed term yields 2.36%while the UVA would suggest close to 2.3% based on the past 90 day total.

and for Februarytraditional deposits would give one in the almost 28 days of this month 2.07% profitwhile the UVA would be close to 2% monthly.

Finally in In March, the traditional fixed maturity would be 2.25% while the UVA would fall to 1.8%.

What happens to the fixed term?

According to economists surveyed iProfessionalAndThe traditional fixed term will perform better again Early next year.

“I have no hesitation in continuing in pesos. I like the traditional fixed term better, because you have the power to negotiate and leave at the right time, which UVA doesn’t allow,” he says. Javier DichristoInvestment manager at Banco Meridian.

In addition, after the elections some prices in the economy are “accommodating”, something that has been impacting inflation since November and benefiting the UVA fixed term.

“After Tensions that impacted the previous period to the elections Last October, internal prices were affected, especially in October and, due to statistical resistance, also in November, by the impact of the uncertainty that would arise from a possible change in exchange rate policy and therefore an appreciation of the dollar. Now it is clearer what will happen,” says Méndez.

Hence the Clarity on the exchange rate strategy and the perception that the “calm” will continue in the coming months “leads us to expect a decline in the monthly growth rate of inflation,” complete.

In short, both those traditional fixed term like him UVA fixed term become valid tools to follow the steps of inflation, in a scenario where the price of dollar It is “frozen”.