Since taking office in December 2023, the libertarian government of Javier Milei has introduced an agenda of fiscal adjustments, exchange rate deregulation and structural reforms with the stated aim of restoring macroeconomic stability. After 24 months, indicators show significant progress on some fronts, although there are others where imbalances persist and raise questions for 2026.

When Milei took office in the minority in both legislative chambers, he focused his economic program on two fronts that he strongly defended: reducing inflation and a zero deficit.

The UCA measured “successes and failures” of Milei management: good inflation and fiscal balance, less consumption and hardly any job creation

After the legislative victory last October, the political map changed significantly for the Libertarian government, which now became the first minority in the House of Representatives, just as Milei wanted to focus on reforms that he considers essential to boost economic activity: among them labor reform – presented in Congress yesterday – and tax reform.

The Spanish newspaper El País analyzed these 24 months of libertarian government based on some variables, of which we extrapolate here the five with the greatest economic weight, namely: exchange rate, country risk, economic activity, GDP and poverty.

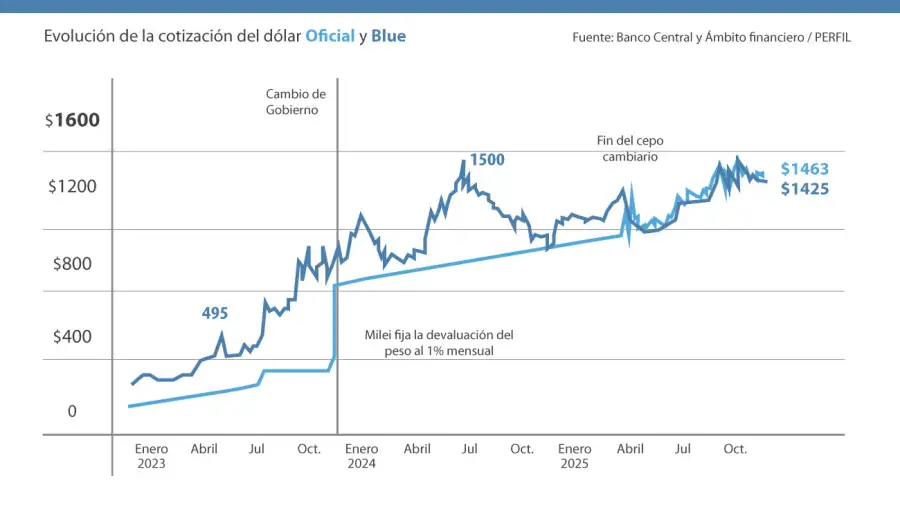

Dollar: From exchange rate chaos to a more “orderly” exchange rate

When he took office in December 2023, Milei inherited an environment of strong exchange rate tensions. Under his leadership, controls on the dollar were relaxed, a “strong peso” regime was introduced, and a radical macroeconomic adjustment was implemented.

This turnaround made it possible to moderate exchange rate volatility. According to the government, the currency gap narrowed and the official dollar experienced periods of devaluation – with a significant initial devaluation – but without a return to inventory levels or permanent restrictions.

Inflation: an abrupt but partial decline

Perhaps the most central metric on the balance sheet: Inflation, which exceeded 200% year-on-year in 2023, began to slow sharply.

By 2024, the annual rate was around 117.8%.

Diego Giacomini criticized Milei for his economic plan: “He doesn’t look at the real economy”

In 2025, the downward trend continued, raising expectations of price stabilization; The government usually touts this downward curve as one of its greatest achievements.

Country Risk: Towards Restoring Financial Confidence

The change in macroeconomic policies, coupled with the stabilization of the exchange rate and disinflation, ensured a return of market confidence. The country risk, which will explode in 2023, has declined significantly in the first two years of the mandate.

This decline reopened windows for external financing and enabled Argentina’s re-integration into international capital markets, something unthinkable just a few years ago.

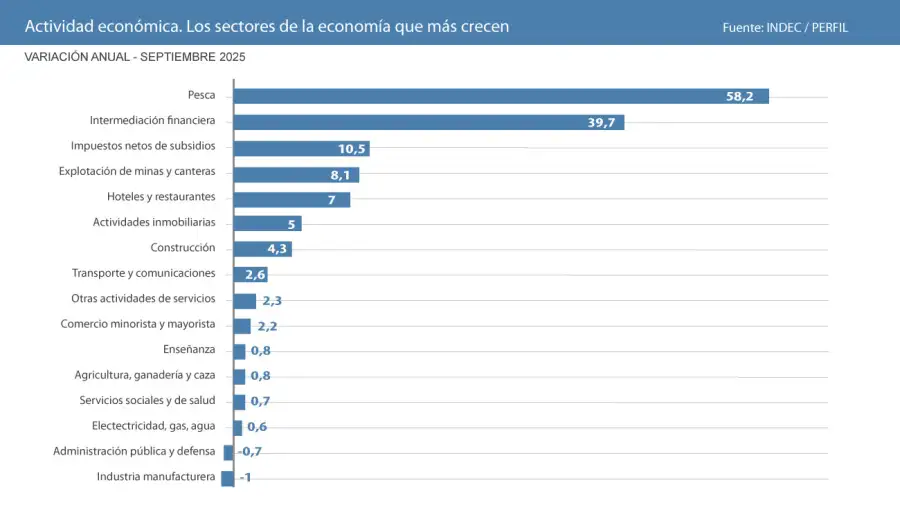

Economic activity: recovery at double speed

Economic activity shows a recovery that is not homogeneous: some sectors are making progress, others are experiencing setbacks.

According to INDEC data, activity increased in 2025 compared to 2024 – a sign of recovery. But within the disaggregated sector, agriculture, mining and finance are driving growth, while industry, trade and construction remain in recession.

This pattern showed a “two-speed economy”: a partial recovery that does not reach all sectors.

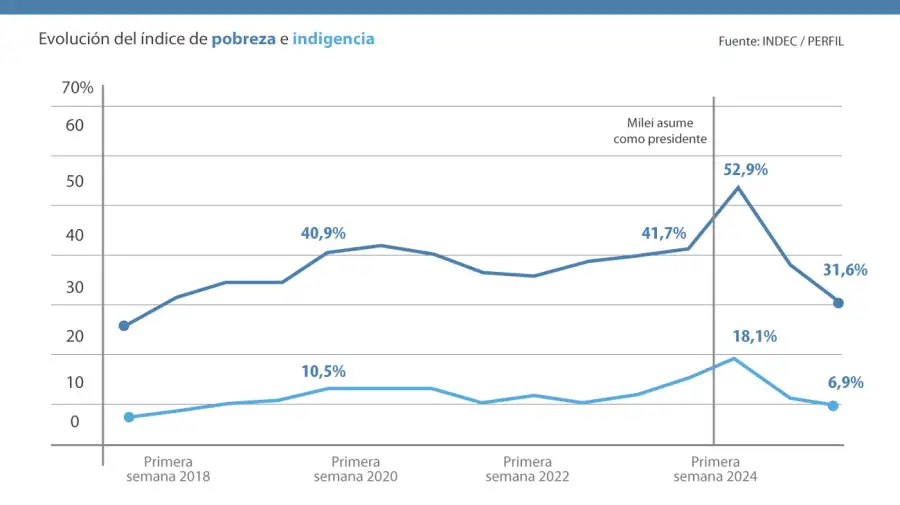

Poverty: reduction, although with doubts about its structural depth

After the shock of economic recovery and the strong initial devaluation, poverty initially rose again in 2024. But according to official information, poverty fell noticeably by 2025: a poverty rate of 31.6% was recorded in the first half of 2025.

Pedro Gaite: “The problem of the Argentine economy continues to be the lack of dollars”

The decline in inflation and exchange rate stability contributed to this improvement – a symbolic fact for the government.

The bThe Milei government’s two-year progress shows remarkable progress in macroeconomic terms: Exchange rate stabilization, fiscal reorganization, decline in inflation, declining sovereign risk, partial recovery of economic activity and statistical poverty alleviation. but at the same time leaves signs of fragility: the economic recovery is uneven, with key manufacturing sectors still depressed; Social improvements can be meager if they are not accompanied by a real reactivation of employment and income. And maintaining confidence will depend on the government’s ability to maintain macroeconomic balance and rebuild reserves.

The big challenge will be until 2026 achieve an inclusive and sustainable economic recoverythat goes beyond financial stabilization and aims at real growth, employment and redistribution.

lr