The Ministry of Finance of Buenos Aires has officially announced the update of the rates of the simplified gross income tax regime. What are the new values?

12/13/2025 – 05:05 am

:quality(75):max_bytes(102400)/https://assets.iprofesional.com/assets/jpg/2024/12/588850.jpg)

The Governmental Administration of Public Revenue (AGIP) of the Autonomous City of Buenos Aires has issued Resolution (AGIP) 543/2025 introducing the update of the rates of the Monotributo – simplified system of gross income tax.

This update will be implemented from January 1, 2026 and is part of the incorporation of this regime into the “Uniform Tax System” implemented by the Customs Collection and Control Agency (ARCA) through Joint General Resolution No. 5769/ARCA-AGIP/25.

This system unifies collection, management and control with the simplified regime for small taxpayers (Monotributo) of the national order, says Errepar.

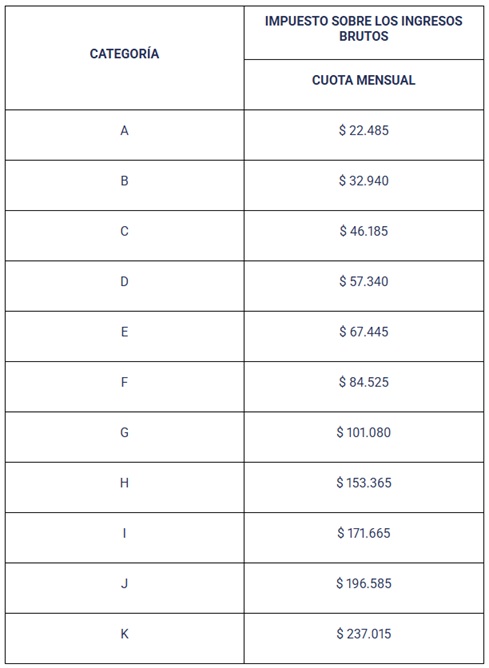

Buenos Aires Monotribute: new monthly fees by category

Taxpayers subject to the Monotributo (simplified gross income system of the CABA) must pay the tax in accordance with the new table set out in Annex I to the Resolution. It is important to highlight that from January 1, 2026, The tax liability is monthly.

Below you will find the table of the new monthly gross income rates for each category of the monotax

Buenos Aires Monotax: What amounts will be paid from January 2026?

Buenos Aires Monotax: Regulatory Framework and Unification

The regulation that authorizes AGIP to make this adjustment is Article 29 of the Tariff Law for the year 2025, which provides for the adjustment of tariffs in the event of changes to the conditions and parameters established by State Law No. 24,977 (National Monotax).

This measure complements the agreement to unify the collection, administration and monitoring of the tax with the national simplified regime in aspects such as categories, payment dates and recategorizations.

In this way, Subjects who have joined the national monotax must participate, together with the national monthly obligation, the fixed monthly amount of the simplified gross income tax regime of the CABA.