After completing the first month of the 2025/26 wheat campaign, foreign trade in grain is showing a development that is unparalleled in recent history. Hand in hand with a production that breaks all historical records, with an estimate by the Strategic Guide for Agriculture (GEA) of the Rosario Stock Exchange (BCR) of 27.7 million tonsSince the beginning of the harvest, the transport of trucks to the ports in the greater Rosario area has noticeably intensified.

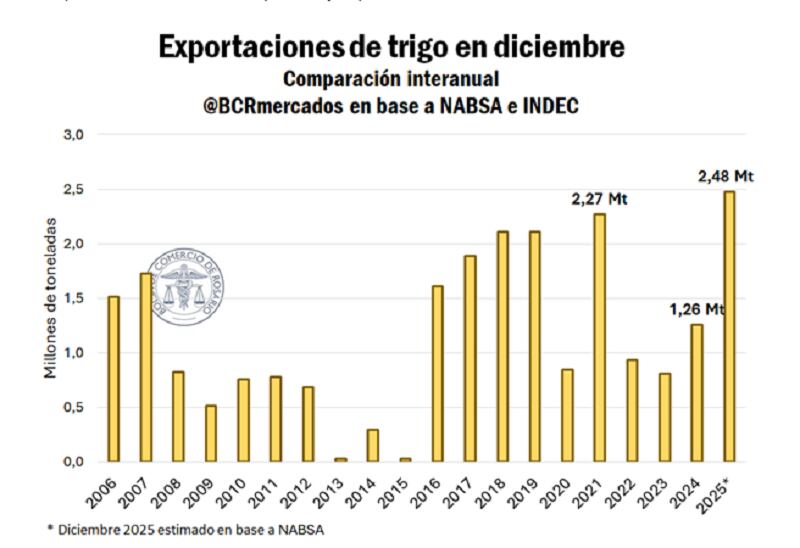

According to the shipping authority NABSA, the ship flow is estimated from the “Up River Paraná” node Wheat shipments for December for 2.48 million tonsa volume that marks a historical record for this month. The record is not only practically twice as high as in the same period last year, but also exceeds the previous record 2.3 million tons in December 2021.

The data becomes more relevant if we consider that the trading cycle for new wheat begins in December. In this regard, the BCR report notes that the speed of deliveries reflects the size of the available supply and the rapid placement of grain on the external market, which is due to favorable price conditions compared to key international competitors.

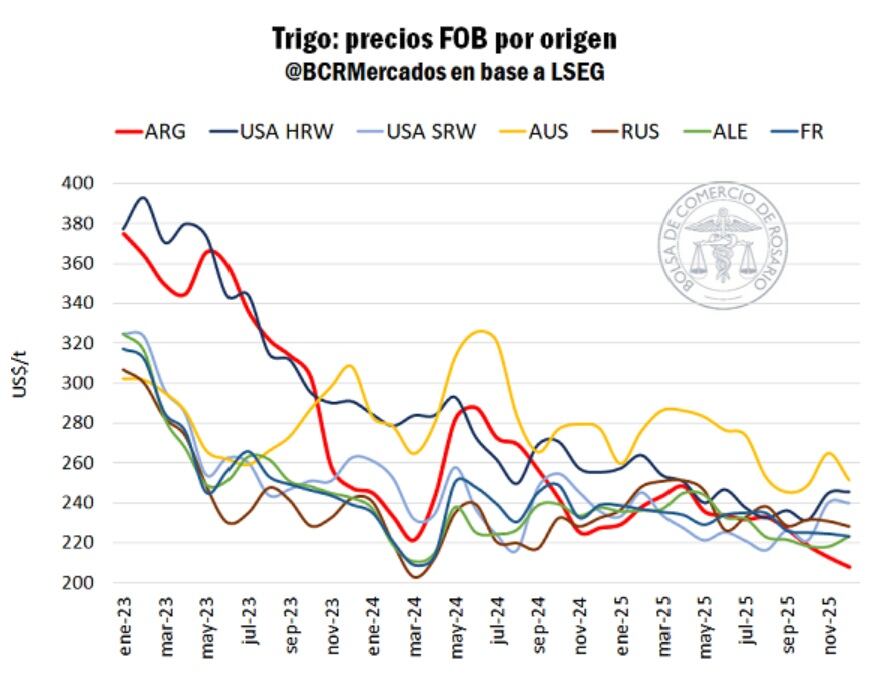

In terms of values, Argentina currently has this The most competitive FOB wheat price in the worlda factor that is boosting grain supplies. This situation made it possible to concentrate exports not only on the traditional Brazilian market, but also to expand to more distant destinations, particularly Southeast Asia.

A report prepared by the Rosario Stock Exchange highlights that in this cycle Brazil is no longer the number one destination for Argentine wheat. Instead, they positioned themselves Indonesia and Vietnamwho top the buyer rankings for the month of December. According to the data collected, Indonesia records purchases from 0.46 million tonswhile Vietnam adds 0.41 million tons. Brazil was relegated to third place with estimated acquisitions 0.40 million tons.

If you join in Bangladeshwhich is in fourth place 0.34 million tonsexplain the three Asian travel destinations Half of the wheat deliveries are planned for December. In this way, the podium of buyers of Argentine grain is made up exclusively of Asian countries, displacing the historical partner Mercosur.

The report also highlights that if only so many deliveries were made to Brazil in December, this would be the case lowest record for this month since 2020when the deliveries arrived 0.31 million tons. However, he clarifies that this trend will be confirmed once the official data from the National Institute of Statistics and Census (Indec) is published. Nevertheless, the observed behavior suggests a change in the composition of Argentina’s wheat targets at the start of the campaign.

In parallel, a relevant event was recorded in the trade connection with Asia. China has completed its first Argentine wheat purchases in three decadesan unusual occurrence considering that the Asian giant usually supplies itself mainly with Australian wheat. According to the report, this historical preference is due in large part to the geographical proximity between both countries, which reduces logistics costs. However, in this campaign, the competitiveness of Argentine wheat allowed this market to be reopened.

In the BCR they point out that “the high diversification of destinations and the significant shipment volumes to buyers, which are not so common at this time of year” are directly linked to the price level and the abundant local offer. In this sense, the document emphasizes that current competitiveness “enables the abundant supply resulting from the historic campaign that Argentina is undergoing”.

Local export performance also occurs in an international context characterized by high global supply. Although the 2025/26 wheat season in Argentina turns out to be exceptional in terms of production, the main exporting countries also recorded significant harvests. According to estimates by the private agency Sovecon Russia would have reached a production of 88.8 million tonswhile Australia is just finishing a campaign 37 million tons. In the European Unionthe quantity harvested was 144 million tonsafter an unfavorable cycle in 2024/25.

This scenario resulted in high levels of world production and put pressure on international grain prices. Within this framework, Argentine wheat managed to position itself as the most competitive wheat in terms of export prices. The report states that the FOB Argentina is between 198 and 205 USD per tondepending on the negotiated protein content.