São Paulo, December 2025 – A silent movement is transforming the way millions of Brazilians manage their rental properties. Driven by automated management platforms such as Pilota Imóveis, landlords are abandoning traditional real estate agencies and taking direct control of their investments – with savings of up to R$1,500 per year per property and credit analysis tools that have already excluded tenants with eviction histories and even outstanding arrest warrants.

The scenario: high rates, no control and risk in choosing a tenant

The traditional property management model charges between 8% and 12% of the monthly rent. In a R$2,000 rental, administration fees consume up to R$240 per month – R$2,880 per year – often without the owner having real-time visibility into fees, defects or adjustments. And the problem doesn’t stop there: choosing a tenant, a critical step that defines the success or failure of a rental, is often done with superficial analyses.

“Many owners don’t realize how much money they are leaving on the table and the risks they are taking,” explains Lucas Roque, founder of Pilota Imóveis. “In addition to the application fees, there are invisible losses: forgotten annual regularizations, fines and interest on late payments not billed. And the worst: tenants approved without serious analysis who then turn into a nightmare.”

A credit analysis that has already avoided eviction and arrest of tenants

One of the differentiators of automated management platforms is the integration with credit bureaus, which allows for more in-depth analyzes than those traditionally carried out by real estate agencies. At Pilota Imóveis, the consultation tool has already identified cases that could have resulted in significant losses.

“We have already had cases where the analysis revealed that the prospective tenant had a recent eviction on his file – information that he obviously did not mention. In another case, the interrogation showed an open arrest warrant,” reports Roque. “These are extreme situations, but they illustrate why the credit analysis cannot be a simple CPF ‘check’. The owner needs to know with whom he is signing a 30-month contract.”

The Digital Rental Agreement feature allows the landlord to record the full history of events with each tenant – delays, complaints, damage to the property – creating a baseline of information that supports decisions when renewing or terminating contracts.

From personal frustration to business: how Pilota was born

The story of Lucas Roque illustrates the profile of the new Brazilian owner. When he began helping his mother manage some family properties, he was faced with a tangle of spreadsheets, scattered contracts and the constant worry of late payments.

“I worked all day and still had to deal with calls from tenants during business hours, invoices to generate manually, adjustments to calculate. It felt like I was working for the properties, not the other way around,” Roque says.

It was from this need that Pilota Imóveis was born. The name refers to the desire to “fly” rentals with precision – taking control of the investment with the same attention to detail that a pilot gives to his plane. “We wanted the owner to feel in control, with full visibility and tools to make informed decisions,” explains the founder.

Self-management numbers

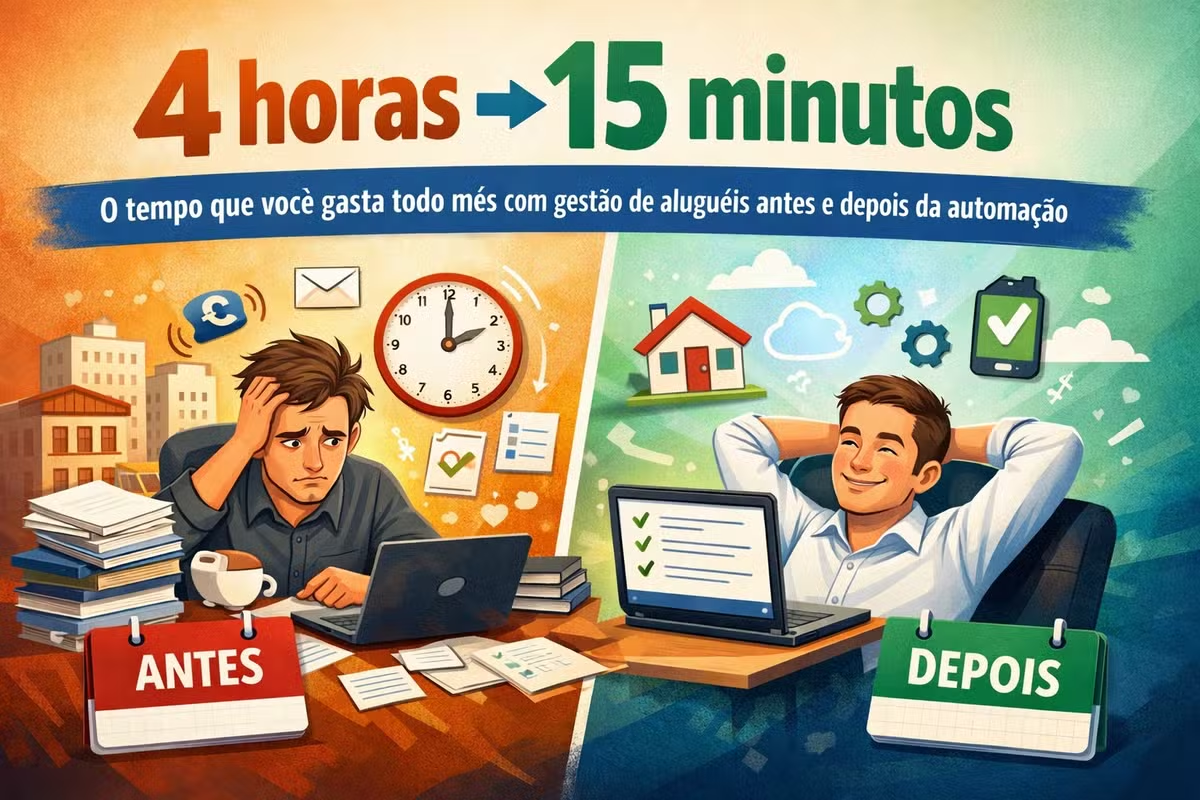

Pilota Imóveis data reveals the impact of automated management:

30% reduction in defects: The rent control system sends automatic charges via WhatsApp and email, with interest calculated at 2% per month and a 10% fine.

Saving 4 hours per month: The time owners previously spent generating invoices and collecting late payments is now reduced to 15 minutes tracking through the panel.

Recovery of lost income: The system automatically applies annual adjustments by the IGPM or INPC, thus avoiding losses estimated at R$1,800 per year per unadjusted contract.

Benefit from delays: For rent of R$1,500 30 days late, the system automatically charges an additional R$180 in interest and fines – an amount that previously went into the tenant’s pocket.

Who is the owner who fires the real estate agent?

The disintermediation movement is not limited to large investors. According to Pilota, the predominant profile is that of couples and independent professionals who own 3 or more properties – often inherited or acquired as a long-term investment.

“These are people who have another job, they don’t want to become full-time property managers, but they also no longer accept paying 10% for a real estate agency to do what a system does for R$49 per month,” explains Roque. “They want control, transparency and knowing in real time who has paid, who is late, how much they have earned.”

What technology brings

Automated management platforms concentrate functionalities that previously required a real estate agency structure: issuance of bank slips with PIX, digital contracts with electronic signatures of legal validity, credit consultation integrated with specialized offices, quotes for deposit insurance and fire insurance from some of the largest insurance companies in the country and automatic charges with a configurable rule.

For income tax, the platform generates organized reports with all the information the owner or their accountant needs for filing. “It is important to be clear: Pilota does not report taxes and has no connection with Federal Revenue. What we do is provide the tools so that the owner has everything organized when he needs it,” explains Roque.

The tenant accesses the portal 24 hours a day to obtain a duplicate invoice, check payment history and download receipts. “This reduces the messages the owner receives by 80% – the ‘send invoice’ message on Sunday evening simply disappears,” he explains.

When real estate still makes sense

Industry experts believe that disintermediation is not suitable for all profiles. Owners who live in another city or prefer to completely outsource negotiations and legal actions can benefit from in-person support from a traditional administrator.

“Technology solves everyday operations. But extraordinary situations – a controversial eviction, an emergency renovation – may still require a physical presence,” acknowledges Roque. “Our proposal is aimed at those who want to save money every day and are ready to quickly resolve exceptions.”

2026: The year of the professional owner

With the Selic rate at high levels and stock market volatility, for-profit real estate investing has once again gained appeal. The self-management movement is expected to gain momentum, particularly among studio and kitnet owners – the fastest-growing segment in big cities.

For 2026, Pilota plans to expand its arsenal of tools: national eviction order directly through the platform, streamlining a process that currently depends on several intermediaries; automated extrajudicial notifications, which formalize accusations and create supporting documents; and issuing invoices to owners of legal entities, adapting the platform to the requirements of tax reform.

“We are witnessing the emergence of a new category: the professional landlord who is not a real estate agent. He uses technology to have total control, charges interest and fines like any business, analyzes credit before concluding a contract, but maintains a direct relationship with the tenant,” concludes Roque. “In 2026, we will offer even more autonomy so that the owner can solve virtually everything without leaving the platform.”