In the next few days, workers will begin receiving the bonus. Beyond paying debts, some arise Investment alternatives in a time characterized by the stability of the dollar and stagnant inflation.

“Every bonus represents an opportunity to improve personal financial health. The important thing is not to leave it alone: invest, even if it is only part of it “It can make a difference and help us end the year in a more predictable way,” explains Vanesa Di Trolio, Business Manager at Reba.

Despite the stability of the exchange rate Dollarizing a portion of income remains a common strategy. “As for the fixed term, we offer one of the highest interest rates on the market (32%). And for those who prefer to purchase US currency, we offer the opportunity to purchase the official dollar directly from your mobile phone 24 hours a day, 7 days a week,” adds the specialist.

In the case of IOL they offer Simple MEP Dollar, a 100% online operation that allows you to convert pesos to dollars in one clickwith immediate accreditation and without restrictions. This means the dollars are immediately available for investing or transferring.

With dollar funds, the IOL Dollar Savings Plus Common Fund (IOLDOLD) is an accessible return option Return 2% per year and enables rescue within 24 hours.

Another alternative are the Common Investment Funds (FCI), which make it possible to invest small amounts. For the conservative profile, the option is IOL Dollar Savings Plus (IOLDOLD). 25% of the fund is invested in US government bonds. The remainder is distributed in low volatility public securities. Over the last two months, it has had a monthly return of 1%.

For moderate profiles there is the IOL Powered Portfolio (IOLPORA): The aim is to outperform inflation and Merval through a diversified strategy that combines bonds, bills, stocks and CEDEARs. Since its launch in June this year The FCI gained 30%, outperforming traditional alternatives such as the dollar and fixed maturity.

Another option is to opt for public securities like BONCER June 2026 (TZX26): is adjusted for inflation and has an estimated return of more than 5.8% per year.

In addition, there is the Global 2035 (GD35), a long dollar Argentine sovereign curve bond with good prospects if the expected reduction in sovereign risk occurs.. It offers a 10% annual return and is chosen by the most aggressive profiles.

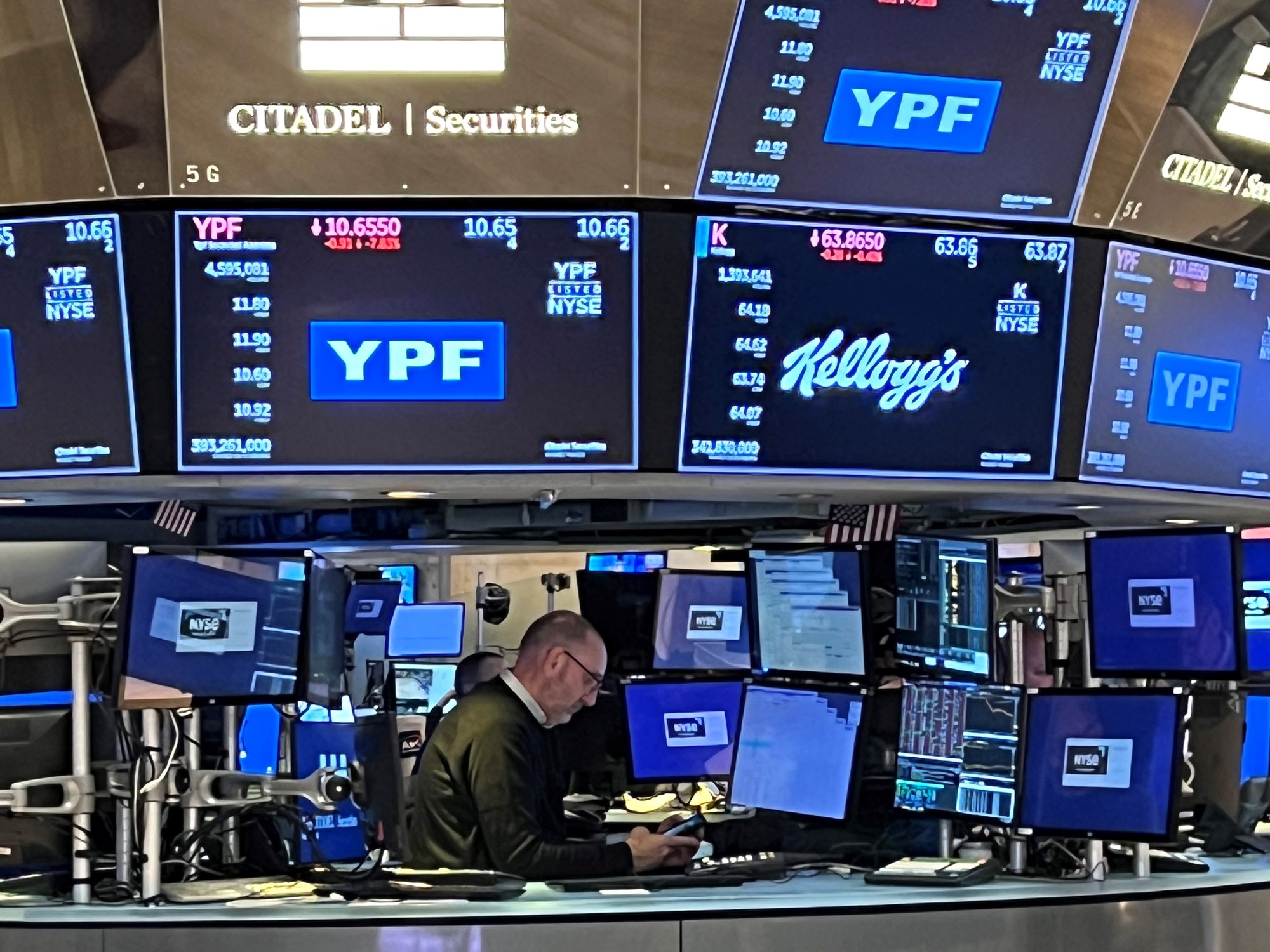

For those who want to diversify, there are stocks and CEDEARs. Appearing on this list are Vista Energy (VIST) and YPF, two bets on the oil business. The Cedear S&P 500, in turn, includes the 500 Largest Companies in the United States.

From Cocos they offer conservative profiles to invest 50% in FCI Cocos Ahorro USD consisting of different ONs. “Ideal for those seeking dollarization without sovereign risk and with daily liquidity to make payments or withdrawals 24/7.”“, they emphasize.

In addition, there is 20% for ON Tecpetrol 2030/2031 and another 20% for Pampa Energía. two companies with good performance and very low relative risk within the Argentine corporate universe.

For the remaining 10% they recommend CEDEAR Coca Cola (KO), “a defensive asset par excellence: stable consumption, global presence, low beta and predictable cash flow.”

In the case of moderate profile, The options are to invest 30% in FCI Cocos Dólares Plus, which includes ONs from PAMPA, Tecpetrol, Brasil 2026, T-Notes and private loans. Another 25% in FCI Cocos Rendimiento, which captures interest rates in pesos without assuming excessive maturity. Then 15% in Tecpetrol, another in Pampa and another in a defensive Cedear.

For one aggressive profile 20% would go to FCI Cocos Acciones, 15% to ON Pampa Energía, 20% to FCI Cocos Dólares Plus, 10% to FCI Cocos Rendimiento (Pesos) and the remaining 35% would be diversified into several cedears, including some technology companies such as Meta a Nubank.