Anyone earning up to R$5,000 per month is now exempt from personal income tax (IRPF), with the changes approved at the end of 2025 coming into force on January 1, 2026. The measure also includes a tax reduction for those earning up to R$7,350 per month. To compensate for the losses suffered by public coffers, taxes on high-income Brazilians have increased. Those who earn more than R$600,000 per year now benefit from a minimum income tax rate. But after all, what changes in IR according to different social classes?

- Income tax 2026: Is it MEI or PJ? Understand the changes for each profile

- New income tax: Calculator shows how much you will stop paying

The bill for the loss of income caused by the exemption will fall on the high-income group, or 0.1% of Brazilians (just over 200,000 people). The minimum IRPF is valid for those who earn more than R$50,000 per month, at a rate that gradually increases up to 10%, for those who earn more than R$100,000 per month.

At this level, as most already pay the minimum, 141,000 taxpayers are expected to be affected by the imposition of the minimum rate of up to 10%, as already announced by the Federal Tax Service.

On the other hand, the Ministry of Finance estimates that 10 million people could benefit from exemptions and reductions.

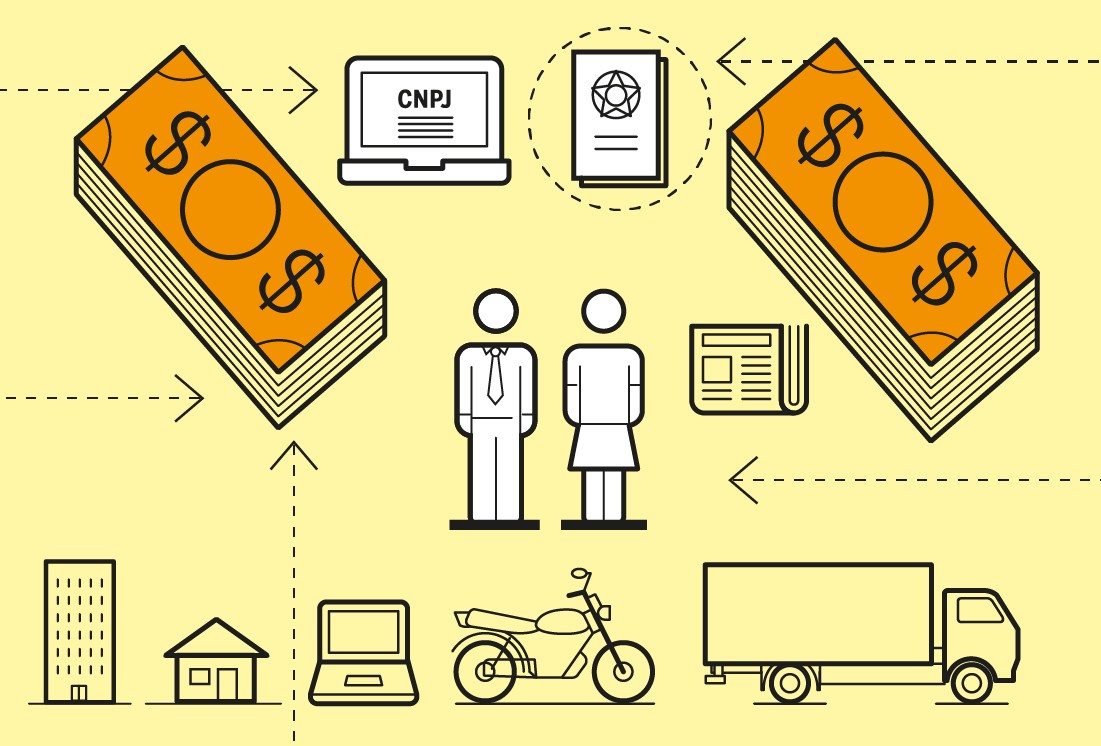

For most Brazilians, including those who can be considered upper-middle or upper class, little will change, as GLOBO’s analysis of changes for five different groups of taxpayers, described below, shows. See below:

Workers with a formal contract and a salary of up to R$5,000 per month

/i.s3.glbimg.com/v1/AUTH_da025474c0c44edd99332dddb09cabe8/internal_photos/bs/2025/q/w/AcgtvfSiKCMBbJHTQdbg/eco-iposto-icones-imagem-1.png)

Workers with a formal contract and a salary of up to R$5,000 per month are exempt from IRPF. Until 2025, only those who earned up to R$3,036 per month (the equivalent of two minimum salaries) were exempt.

Anyone earning between R$3,036 and R$3,533 per month paid a rate of 7.5% (with a deduction of R$182.16). This percentage increased depending on the income bracket until it reached 27.5%, for income above R$5,830.85 (with a deduction of R$908.73).

The effective rate (the percentage of total income paid under IRPF) is lower, because it takes into account deductions (which reduce the total amount on which the nominal rate will apply) and any income exempt or subject to specific taxation.

Workers with a formal contract with a salary of R$5,000 to R$7,350 per month

/i.s3.glbimg.com/v1/AUTH_da025474c0c44edd99332dddb09cabe8/internal_photos/bs/2025/I/T/Ep0px5RTafsHSlzNg6gA/eco-iposto-icones-imagem-2.png)

In the new IRPF there is a specific table for those who earn between R$5,000 and R$7,350 per month. The rates are progressive, increasing gradually as income increases, and there is an automatic deduction, to prevent anyone earning a little more than R$5,000 per month from having to pay IRPF and, therefore, ending up with a net salary lower than the exemption ceiling.

As a result, anyone earning between R$5,000 and R$7,350 per month will pay less IRPF than they did until 2025.

Liberal professionals with a formal contract and a salary greater than R$50,000 per month

/i.s3.glbimg.com/v1/AUTH_da025474c0c44edd99332dddb09cabe8/internal_photos/bs/2025/I/E/SRHg2RQ8SQrCVw4JhQ3A/eco-iposto-icones-imagem-3.png)

Dentists, architects, lawyers and other independent professionals with a formal contract and a salary of more than R$50,000 per month will continue to benefit from the current IRPF rate of 27.5% deducted from their payroll. Only those who earn more than R$50,000 per month and whose effective rate is lower than the new minimum rate table will be subject to the minimum IRPF fees.

For those who earn between R$50,000 and R$100,000 per month (from R$600,000 to R$1.2 million per year), the minimum rate will gradually increase until it reaches 10%, in the upper bracket.

According to calculations by the USP Macroeconomics Research Center (Made), with data from 2023, the Brazilians who pay the highest effective rate are those whose average income is R$29,685,000 per month, with almost 12% IRPF — that is, for them, nothing will change.

From this income range, the effective rate decreases. The group that is part of the highest 0.1% income group in the country earns on average R$392,582,000 per month and, before the changes, paid an effective tax rate of 7.4%. It is the taxpayers who will pay the minimum of 10%, with an increase in taxation.

Liberal professionals with an income of more than R$50,000 per month and who work as a legal entity

/i.s3.glbimg.com/v1/AUTH_da025474c0c44edd99332dddb09cabe8/internal_photos/bs/2025/U/p/iwvtWDQY2qSLJ3Mrs28A/eco-iposto-icones-imagem-4.png)

Let’s take as an example an independent professional who works through a company, providing services — this is the case of a doctor who has his own practice, an engineer who has a consulting firm or an architect with his practice — and who has a monthly income of R$55,000.

The company collects corporate income tax (IRPJ) at rates that vary depending on the income range and activity, generally under the simple regimes (for companies with annual revenues of up to R$4.8 million) or presumed profit (for companies with revenues of up to R$78 million per year).

The remuneration of this professional, partner-owner of the company, is paid in the form of dividends, that is to say the distribution of the company’s profits. Today, this type of income is exempt from IRPF. To know if you will pay the minimum IRPF, the professional must calculate your effective tax rate by including all your income, including dividends, in the calculation.

In the event that all of the professional’s income comes from dividends, he does not currently pay any IRPF.

What changes? According to the new rule, he will pay the minimum rate according to the new scale. For an annual income of R$660,000, it is 2.5%. Anyone who receives more than R$50,000 per month in dividends will pay IRPF at source, at the rate of 10%, which may possibly be refunded, after the annual adjustment declaration, if the effective rate is higher than what it should be according to the new table.

Professionals who earn more than R$50,000 by combining the salary of a formal employment contract and that of the company

/i.s3.glbimg.com/v1/AUTH_da025474c0c44edd99332dddb09cabe8/internal_photos/bs/2025/Y/J/1fjcM7Q0SA50KfJOqRNQ/eco-iposto-icones-imagem-5.png)

In this case, the sum of all income is also valid to calculate the effective tax rate. The total, taking into account income from a formal contract – on which the 27.5% wage rate continues to apply – and other income (such as rent), will be taxed under the new rule if it exceeds BRL 600,000 per year.

If, at the time of making the regularization declaration, the effective rate, which will take into account the IRPF withheld at source, is greater than 10%, nothing will change for this professional.