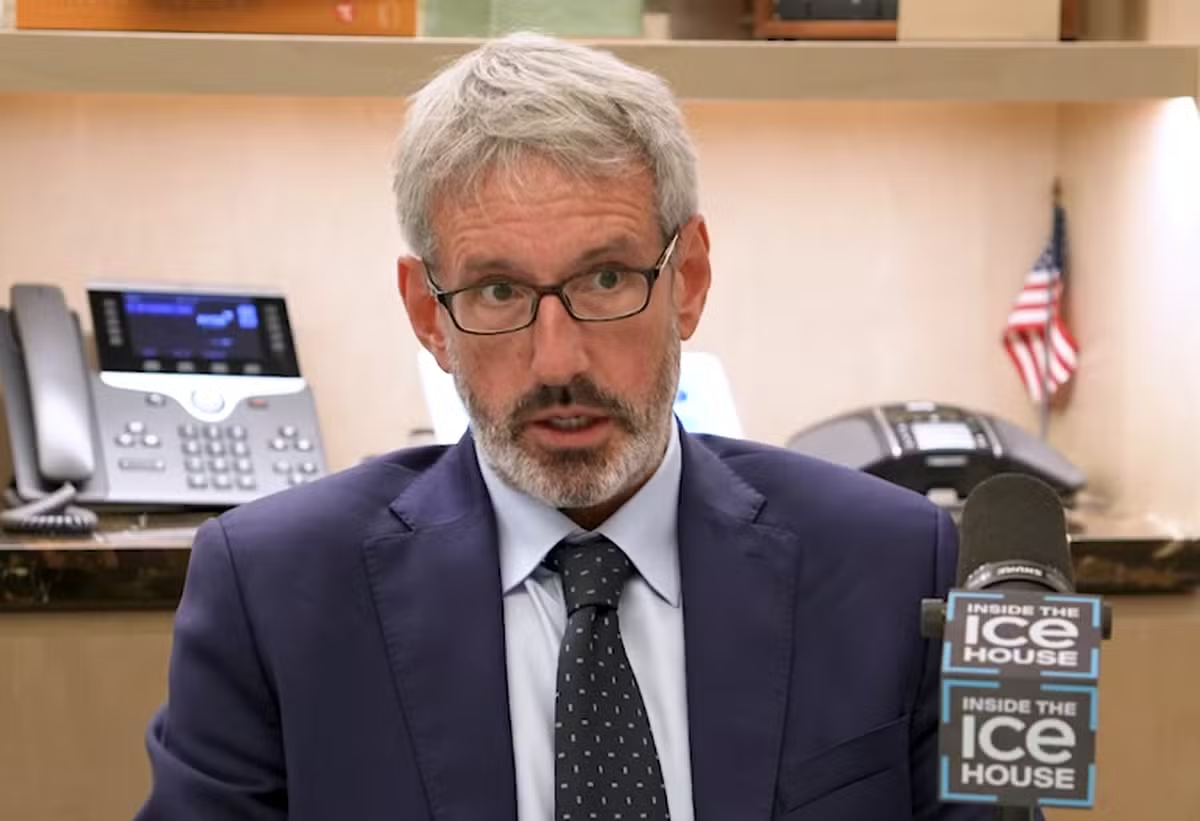

High interest rates in Brazil benefited the real due to the “carry trade” strategy, which involves borrowing resources in one country with lower interest rates and investing the capital in another country with higher interest rates. The increase in election-related volatility could, however, put this situation at risk, as assessed by Eric Bienemerging markets portfolio manager at VanEckwhich manages $162 billion in assets. “We’re talking about a very popular position, both onshore and offshore. This tends to amplify volatility,” he says.