After the government made changes Exchange programmarket variables didn’t take long to react and give their verdict on the new short-term outlook. Local investors received the new definitions with a massive rotation towards CER bonds – public debt instruments whose capital is adjusted to the development of inflation. This move confirmed that the market was experiencing a higher rate of price appreciation than predicted before the announcement.

The official decision, the. to provide more flexibility Upper limit of the exchange rate led to an immediate realignment in the committees of the city of Buenos Aires. The so-called Breakeven inflationa technical variable that indicates what level of inflation would compare the yield on a fixed-rate bond to the yield on a price-adjusted bond jumped from values near 21% a year to a new threshold of 26% by 2026. This indicator serves as a thermometer to measure the latent expectations of economic actors regarding the new monetary scenario.

Juan Manuel TruffaEconomist at the consulting firm Outlier, analyzed this phenomenon and explained the logic behind the behavior of prices. According to the expert, the market has validated a new configuration in which disinflation occurs more slowly. “The market expected inflation to be slightly higher as more space was given to the upper band. Also because of the configuration, you can assume that there might be some feedback as the exchange rate, if the band, the exchange rate adjusts in light of past inflation, so that there is more scope for a slightly slower reduction in inflation, for exampleTruffa remarked.

For analysts GMA CapitalThe recent announcements were “music to the ears of investors” seeking definitions for reserve management and the exchange rate system. The company reported that in this context, government bonds denominated in dollars, so-called global bonds, showed unusual strength. The GD30 security recorded gains of 2%, while the long part of the maturity curve rose up to 4%. Thanks to this impulse, the… Country risk began a compression path that placed it in the area of the 570 basis pointsa value that the market interprets as a firm step towards normalization of government credit.

The brokerage firm’s report highlighted that “The spreadsheets for carry, which used to have Lecaps as protagonists, are now being rewritten with indexed bonds“According to this new logic, CER bonus With its maturity in December 2026, it proved to be an ideal instrument to hedge against fluctuations in the upper limit of the exchange rate band. In a scenario with nominal annual inflation of 30%, this instrument would be positioned 0.9% above the exchange rate band, ensuring a positive return for holders.

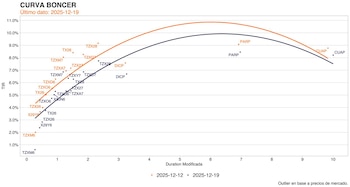

The brokerage company, for its part Cohen details the specific performance of assets in pesos during this strategic turnaround. Inflation-indexed debt led gains, rising 2.6%, offering yields of CER +4.5% in the short tranche and up to CER +7% in the longer terms. Now it is implicit inflation by 2026 it corrected upwards and was 24.2%.

In contrast to the brilliance of the indexed instruments, the instruments at Fixed price suffered from the effects of inflation uncertainty. The fixed yield curve lagged with a marginal increase of 0.1%. In the short tranche, yields rose from 24% to 26% of the annual nominal interest rate (TNA), a direct response to investors’ need to offset the risk of a currency depreciating faster than initially expected. He Bonte (Treasury Bond) also reflected this market cold with a decline of 0.4%.

The reconfiguration of expectations was not a coincidence, but a response to the economic team’s new priority: the accumulation of reserves. The change in the exchange rate band methodology allowed the central bank more leeway to intervene and purchase currencies, a goal that the market strongly demanded. Truffa argued that this move improved the system’s solvency by reducing interest real appreciation of the peso, that is, it prevented the country from becoming artificially too expensive in dollars.

“The government said we understand a little bit that we need to buy reserves, the market told us, OK, we take note of it. We know that there may be a slight increase in the exchange rate at some point because we didn’t buy, we held back and now we have to buy“said the Outlier economist. He added that this path, although it implies slightly more persistent inflation, is better than forcing a fall in prices that suppresses external competitiveness.

However, the dynamics of the local market showed some distortions typical of its small size. The jump of Breakeven inflation According to experts, up to 28% reacted to sudden portfolio movements at some daily closes that shifted the price curves beyond the theoretically specified level. Because the Argentine market lacks tremendous depth, large deals by investment funds or banks have disproportionately changed returns.

In the futures and derivatives market, assets dollars linked – which adjust to the official exchange rate – rose by 1.1%, accompanying the currency’s upward trend. These securities represent a devaluation of more than 0.9% compared to the first quarter of 2026. According to Cohen’s data, current prices discount a implicit devaluation 10.1% for the period, showing that exchange rate hedging is still present on corporate treasurers’ radars, although price index-linked securities continued to dominate in absolute terms.

The current scenario has configured an ecosystem where the investor sees this CERIUM as your most important ally. The logic is simple: When the dollar’s ceiling moves due to past inflation, the indexed bond provides natural protection. When the nominal value of the economy accelerates, the bond’s capital is adjusted in the same proportion, maintaining hard currency purchasing power against the exchange rate cap set by the monetary authority.

The data from GMA Capital They highlighted that the expected mid-year dollar, the so-called breakeven dollar, rose from $1,640 to $1,690 over the course of a week. This adjustment of 50 pesos in anticipation of a devaluation consolidated the portfolio rotation. Investors preferred to forego the security of the fixed interest rate, which remained at a stable level Tamar (27.3%) and suretyship (21%) take refuge in pure indexing.