Even at the end of 2025, consumption will remain at the center of the economic discussion. In a context where a disinflation process has taken place, settling at around 2% per month, and with activity showing mixed signals, demand indicators offer a clue emphasizes the official narrativefocused on lowering prices as the main way to improve living standards. However, recent data suggests that this relationship is not leading to a sustained recovery in consumption, at least in the short term.

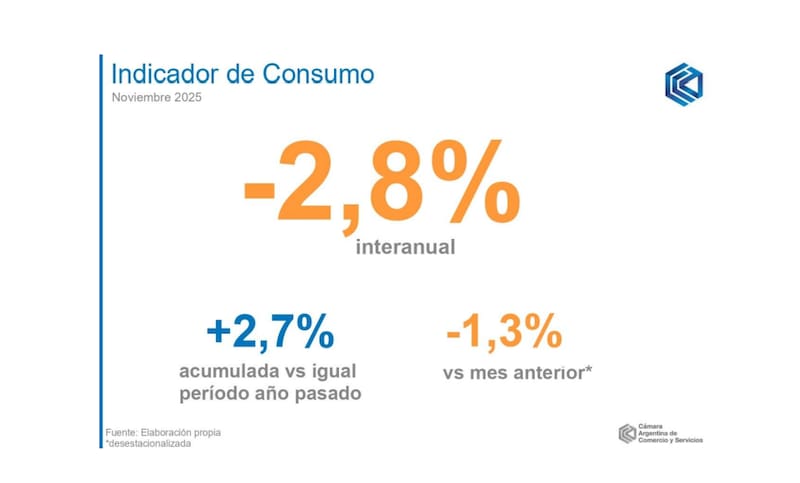

According to the latest report from the Argentine Chamber of Commerce and Services (CAC), the Consumption Indicator (IC) recorded an annual decline in November 2025. 2.8%while the seasonally adjusted measurement showed a monthly decline 1.3% compared to October. This is a result that breaks a predominantly positive development over the course of the year and this once again brings the fragility of household consumption into focus.

The report shows that the average nominal income per household was $2,582,000 in November, although in real terms there was a slight decrease compared to October when the effects of inflation are excluded. At the same time, the consumer price index recorded an increase of 2.5%what the Third consecutive fluctuation above 2%after several months of relative stability in this area. Year-on-year inflation reached the value 31.4%with a cumulative 27.9% so far in 2025.

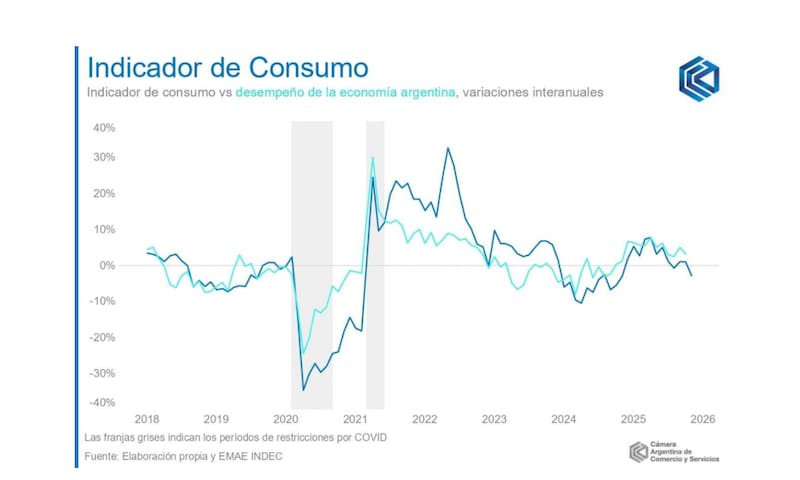

Based on the CAC, they suggest that the development of consumption must be analyzed in connection with the behavior of economic activity. In this sense, the report recalled that both in 2024 and most of 2025 The consumption indicator and the Monthly Economic Activity Estimator (EMAE) had the same address generally, although at different speeds. For October – the latest data available – the EMAE has grown 3.2% year-on-yearwhile the CI still showed a positive variation. However, seasonally adjusted consumption fell 0.5%breaking a streak of increases in three consecutive months.

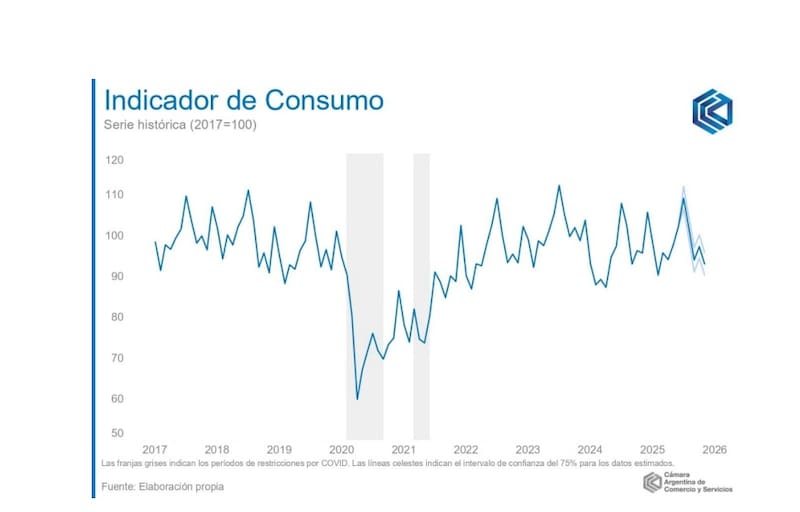

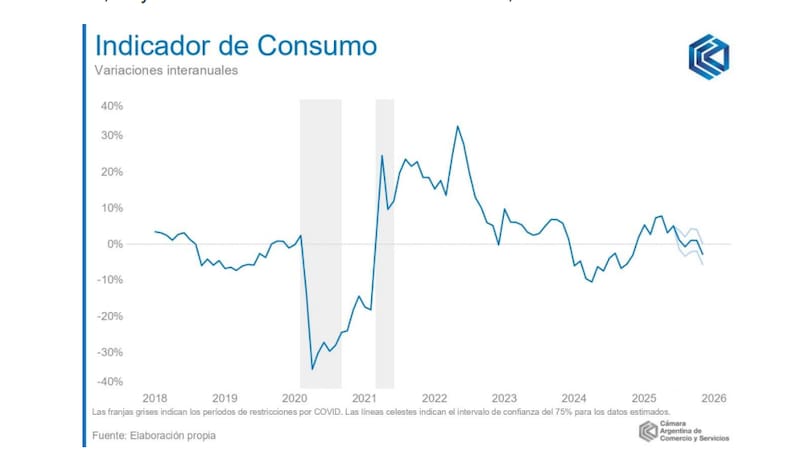

The longer-term comparison allows us to sizing Consumption volatility in recent years. The historical series of the consumption indicator with a base of 2017=100 shows a clearly irregular course with significant fluctuations and a “saw-like” behavior that reflects the macroeconomic instability of the period. Within this development, two abrupt declines stood out in 2020, which were related to the effects of the pandemic and left lasting marks on consumption levels.

Since the inauguration of Javier Milei on December 10, 2023, the series has shown a Recomposition phase after a contractionary 2024, but without consolidation of a linear trajectory. Over the course of 2025, the indicator recovered year-on-year, partly explained by a low comparison base, but the monthly measurement alternated progress and setbacks. This pattern suggests that, beyond some macroeconomic stabilization, consumption continued to be sensitive to changes in income, prices and expectations.

The report also included an analysis of the Relationship between consumption and disposable household income. The table comparing the consumption indicator with the development of income shows that both variables did not always move in sync. In some periods consumption was accompanied by the improvement in real income, while in others it was decoupled, showing that the recovery in purchasing power did not automatically lead to higher levels of spending. This divergence provides a key to understanding why the decline in inflation alone does not guarantee a sustainable recovery in consumption.

When considering the composition of the indicator, heterogeneous behaviors were verified by category. Clothing and shoes grew in November 16.8% year-on-yearwhich, given a low basis for comparison, contributes a positive percentage point to the overall index. Leisure and culture advanced 5.2%while transport and vehicles declined 2.0% and housing, rents and public services declined 0.6%. The remaining items recorded a decrease compared to the previous year 5.7%with a significant negative impact on the bottom line.

In terms of mass consumption, consumption of fast-moving goods (FMCG) stagnated with a decline compared to the previous year 0.1% and a monthly seasonally adjusted decline 1.8%. The report points out that although mass consumption recovered slightly after the sharp adjustment in 2024, Consumption of durable goods continued to increasealbeit at an increasingly slower pace, in a context of more volatile loans and high interest rates.

In summary, the CAC concludes that consumption will fall by 2025 Sign of greater stabilityBut no solid recovery. The weakening of inflation, which has settled at a low level and has accelerated slightly in recent months, has so far not been able to be reflected in a sustained improvement in household spending. At this point, consumption once again appears as one of the indicators that most challenges the official narrative will continue to be key to assess the pulse of the economy as we enter 2026.