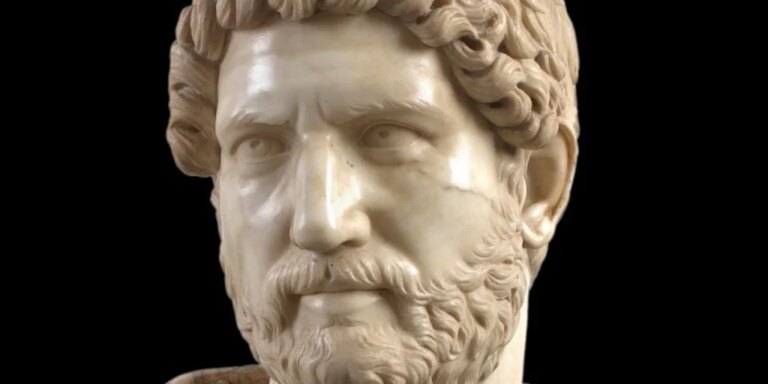

The central bank presented its guidelines for 2026 this Monday. This is what the organization led by Santiago Bausili says now after cleaning up its balance sheet and solving the problem of excess liquidity “Phase 4” of the program begins In addition to a sustained decline in inflation, it will be characterized by the Accumulation of reserves through remonetization of the economy. That means putting more pesos on the market in exchange for dollars.

As the central bank puts it: “Monitoring and controlling monetary aggregates will be crucial.” next level of remonetization. The money supply will accompany the recovery of the demand for money and its supply will be prioritized by the demand for money accumulation of reserves international”. The company is obliged to present its plans for 2026 before the beginning of the year.

The repurchase of reserves will start from January 1st. he adds. It has already announced that it will only buy up to 5% of market movements per day and will make off-market block purchases. This day also begins the new exchange rate bands, the upper and lower bounds of which change every month according to the latest monthly inflation data reported by INDEC (i.e. with a two-month lag).

But unlike Luis Caputo, who said he wanted to limit Wall Street’s dependence on debt problems, Bausili assures that restoring access to international markets is key of debt to refinance the capital maturities of the national treasury. In addition, he notes that “this process coincides with the growth of financing in the external market of companies.” will enable the flow of reservation purchases, on this occasion, This results in an increase in the stock of BCRA’s international reserves, as these should not be used to pay principal and interest maturities.

It also states that they promise to make the exchange rate that will be maintained for companies more flexible if the markets are accessible and the foreign exchange market remains calm: “To the extent that progress is observed in strengthening the balance in the foreign exchange market and a fluid access to external markets from the Ministry of Finance, BCRA may consider it appropriate to continue to make foreign exchange restrictions more flexible that remains Stocks of dividends and debt payments commercial projects before 2025”.

Although restrictions on individuals were lifted last April, this is still the case Certain restrictions remain in place for companies.

On the other hand, the BCRA will continue to advance the normalization process Bank reserve policy, rrecognizing its impact on monetary balance and financial intermediation. Any change will be implemented in line with price stability and credit restoration.