Europe is witnessing a new economic phase in which the financial sector is at the center of transformation. Interest rates, regulatory pressures and environmental transformation create a demanding and opportunity-filled environment. Banking faces a decade ahead … Crucially, you must redefine your operating model, integrate sustainability into your business and leverage technology to enhance customer confidence. Spain has an advantage thanks to its financial solvency, level of digital transformation and system maturity, although outstanding challenges require speed and long-term vision.

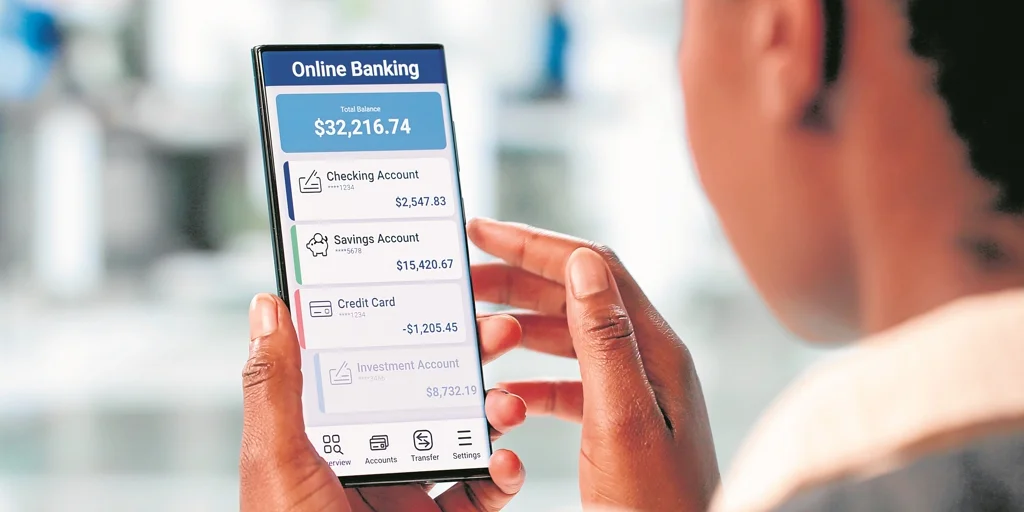

Alejandra Kindelán, President of the Spanish Banking Association (AEB), insisted that digitalization is already a driver of innovation and progress that places Spanish banking among European leaders. In the past decade, entities have doubled their investments in technology and security, and more than three out of four citizens work on digital channels daily. Cases like Bizum’s demonstrate the financial system’s ability to innovate and collaborate, although Kindelan warns of an obvious danger: “Maintaining competitiveness without losing customer confidence, which is banking’s greatest asset.” Following this leadership, the sector needs to gain the flexibility to adapt to an environment in constant motion.

Francisco Joaquín Cortés, Professor at Alfonso Technologies such as blockchain, artificial intelligence or big data change the relationship with customers and risk management. The emergence of fintechs and big tech companies has opened an ecosystem in which regulation, cybersecurity and inclusion are consolidated as pillars of sustainable and competitive transition. Modernization affects not only the internal structure of the bank, but also its way of competing on a global scale.

Oscar Bagno, business and technology strategist at T-Systems Iberia, points out that Spain faces this stage with an advantage “in the field of digitalization and cybersecurity, despite the acceleration of the global race.” Neobanking and FinTech are redefining the user experience through… Super apps and instant servicesThe speed of payment and the contextual value of information become new service metrics. He asserts that traditional entities “will have to reinvent themselves to remain relevant. The difference between competing and leading will depend on the ability to anticipate and leverage the value of data in real time.”

The boundaries between finance, technology and digital services are blurring. In this hybrid region, cooperation between banks, startups, and technology providers has become a strategic factor no less important than financial solvency or profitability.

Cultural evolution

On the regulatory front, generative AI, coding and European standards – Dura and MICA – are redefining the financial architecture. “Dora enhances cyber resilience and Mica provides legal security for cryptocurrency assets». Change is not limited only to the technical level, but also requires a cultural evolution that prepares entities to operate in open and collaborative environments. In these places, transparency and user protection become the true foundation of trust.

Mario Aguilar, vice president of banking and insurance at Capgemini Spain, sees a profound shift in technology adoption. He adds that digitization is not a destination, but rather a destination A continuous process that passes through the entire value chain. The expansion of the cloud, instant payments, or advanced automation has fostered more efficient and connected banking services. Furthermore, “modular architectures based on open APIs allow creating new services without friction and bringing tools previously reserved for large enterprises to SMEs.” Technological advances not only reduce costs, they free up resources for closer, more personalized attention, which is key to building loyalty among increasingly demanding digital customers.

This digital revolution is also redefining the relationship between finance and society. Daniel Foster Lopez, Partner in Charge of Financial Services at NTT DATA, believes the future of the sector lies in being sustainable and people-focused. Financial education and digital inclusion have become pillars of a balanced economy. He emphasizes that technology should empower the customer and not alienate him, and its value lies in simplifying operations and bringing banking services closer to the citizen. He adds that social purpose “is now closely linked to profitability, and the next wave of innovation will be measured by its ability to reduce gaps in knowledge, credit and participation.”

“Europe risks losing its relevance if it does not adapt its regulation to the pace of innovation,” warns Mariano Lasarte, finance partner at KPMG. Excessive bureaucracy“He stresses that it reduces agility compared to other markets.” A framework that accompanies progress with simple and proportionate rules would restore the dynamism of the financial system. For him, “strengthening cooperation between institutions and regulatory bodies is essential to achieving a balance between monitoring and experimentation without slowing down the development of the sector.”

Sustainability is established as a true driver of value. “Integrating environmental, social and governance criteria allows us to anticipate risks and direct capital towards projects compatible with the green transition,” says Pablo Faño, also a partner in financial services at KPMG. This vision transforms the relationship between banks, investors and customers, “putting trust and the long term at the heart of the strategy. Transforming sustainability into a true lever for growth will distinguish entities that evolve from those that are left behind.

In the cultural field, Miguel Ángel Barrio, of IEB, believes that technological transformation will only reach its true potential if it is accompanied by technological transformation. Change the mindset. It is not enough to renew systems or strengthen resilience: leadership, training and a shared vision are needed. Beyond the tools, what is key is people and their ability to adapt innovation to the values and goals of each organization. It also highlights the need to protect systems from fraud and digital incidents, a critical aspect of the new open banking.

Cortés, of the Alfonso The speed of change is forcing us to “rethink risk management, decision making and talent development.” Continuous learning and flexibility will define the boundaries between the entities that will lead the next decade and those that will be left behind. Internationally, “competition has become more intense.” Banyo points out that digitalization has erased boundaries and that users compare banking to any other digital service. “Europe cannot afford to move at the slow pace set by bureaucracy,” warns KPMG’s Lasarte. The two parties agree on the urgent need to promote a more flexible European financial market, capable of attracting investment and supporting innovation at the pace of technological forces.

The customer relationship has become the real terrain of competitiveness. At Capgemini they sum it up bluntly: “Anticipating needs and delivering seamless and safe care will make a difference.” Aguilar explains that trust is built with everyday experience – secure payments, simple processes, and transparent communication – while Baño highlights the importance of Maintain empathy and consistency in every interaction. Innovation without losing the human dimension is the essence of future banking for both of them.

NTT DATA’s Foster agrees that technology should bring banking closer to citizens, not further away. He insists that financial education and digital inclusion are pillars of a more participatory economy. The sector’s success will not depend on technical development, but on its ability to reduce gaps in access to services and ensure that no one is excluded from the new economy.

A pillar of stability to guide change

The insurance sector is going through a critical stage characterized by digital transformation, climate change, and the development of savings. At a recent insurance meeting organized by Deloitte, ABC and Mapfre, Merencho del Valle Chan, President of Unespa, positioned insurance as a key pillar of European economic stability. He stressed that insurance companies manage assets worth more than fifteen trillion euros and play a major role in directing investment towards green transformation and economic flexibility.

Del Valle advocated simplifying the European regulatory framework to free up capital and encourage long-term investment, especially in sustainable projects. He also insisted on the need to “strengthen financial education and reactivate supplementary savings in pensions through tools such as automatic enrollment or European products.” Regarding climate issues, he highlighted the strength of the Spanish system, based on cooperation between private insurance companies and the Insurance Compensation Union, which allows a rapid response to natural phenomena. But he warned of “insurance gaps in housing and rural areas and the importance of enhancing prevention and social awareness.” At the technological level, the President of UNISPA indicated that digitalization must be a A tool to enhance sector resilienceAs long as it is managed ethically and securely. He stressed that insurance is, at its core, a data-driven industry, and that its ability to innovate must be accompanied by responsibility and trust.

Jaime Romano, professor at EAE Business School, agrees that digital transformation and sustainability are redefining the future of the sector. He sees artificial intelligence, data analytics and coverage personalization leading to “a new intelligent insurance model, adaptable in real time to customer needs.” Romano also identifies talent, collaboration with InsurTech, and ethical information management as pillars that will ensure competitiveness and trust in the next decade.