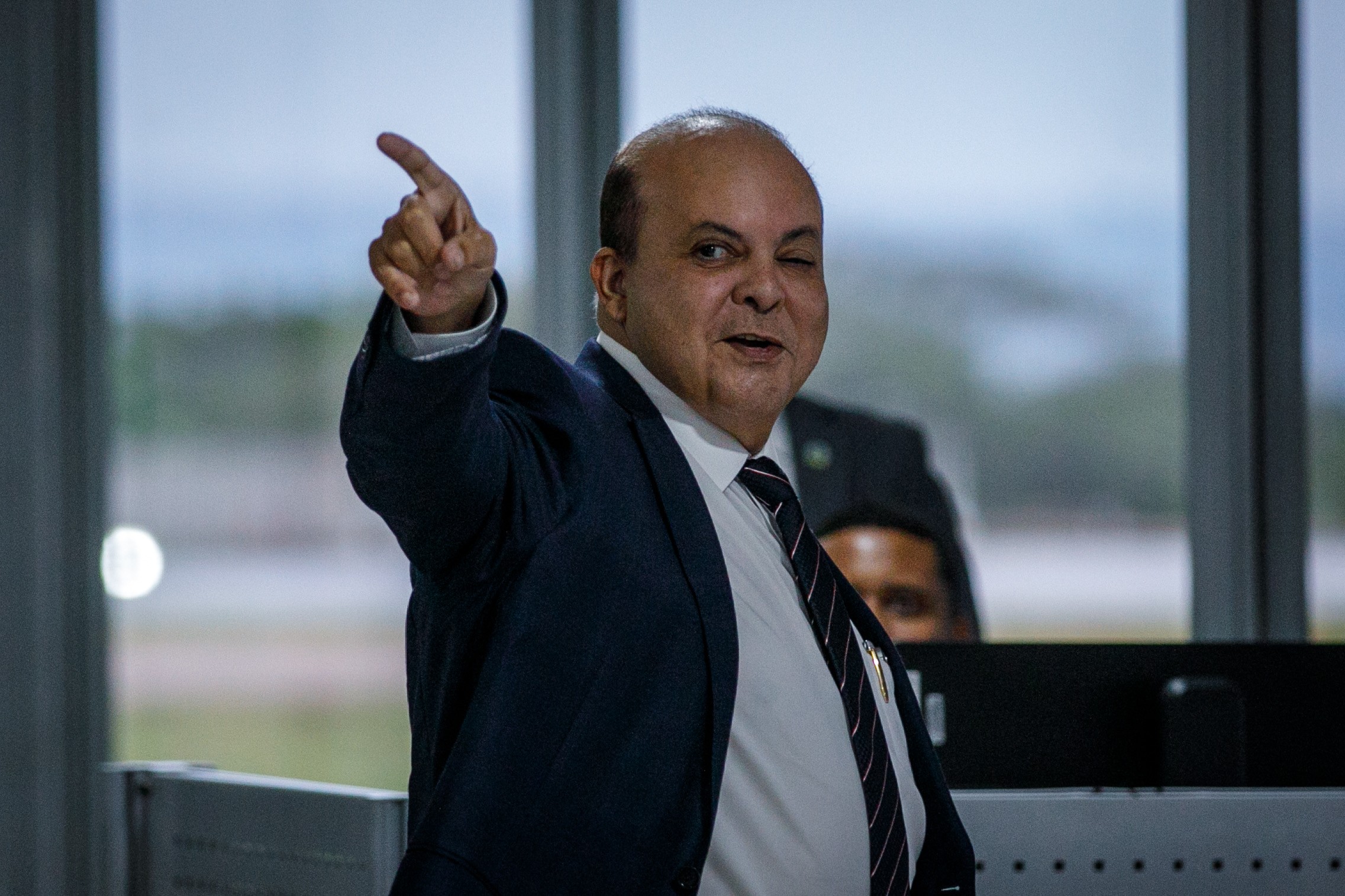

Federal District Governor Ibanes Rocha has appointed Nelson de Sousa, former president of Caixa Econômica Federal, as president of the Bank of Brasília (BRB). He takes over from Paul Henrique Costa, who has led the institution since 2019 and was removed from his position by court decision, as part of the Federal Police’s Operation Zero Compliance, which resulted in the arrest of the owner of Master Bank, Daniel Forcaro.

This Tuesday, the governor’s office informed that the BRB will be led by Celso Eloy Cavalheiro, Caixa supervisor in Brasilia.

In a note issued on Wednesday, the GDF press office said Nelson’s name was notable because of his artistic profile.

“The Governor of the Federal District, Ibanes Rocha, has appointed Nelson Sousa to take over the presidency of the Bank of Brasilia (BRB). The selection of the former president of Caixa Econômica Federal Bank (CEF) for this position is of a technical nature, as the chosen person has more than 45 years of experience in the financial and banking sector,” the DF government’s memo said.

The Ibanes administration also says that Souza “will send the necessary documents to the Central Bank. After that, his name still needs to be approved by the Legislative Council of the Federal District.”

Internal documents from the Supervisory Area of the Central Bank (BC) indicate that the BRB had to create “accounting records without documentary support” to comply with financial sector rules, after purchasing credit portfolios from Master.

The Federal Police (PF) is investigating suspected irregularities in the sale made by Master – whose president Daniele Forcaro was arrested on Monday – to the state financial institution controlled by the federal district government.

Only between July 2024 and October 2025 was the corresponding amount of $16.7 billion transferred to the main group by BRB, according to investigators.

The technical field at the Central Bank indicated, in internal documents, that the “high demand for acquisitions” generated operational impacts on the state-owned company.

All banks need to hold a certain amount of capital to cover the risks they take when lending money. This is measured through an index that varies depending on the size of the institution, but must be followed by banks.

However, BC technicians pointed out that the BRB indicators were already close to the minimum, mainly due to the acquisition of Master assets, and turned negative at the beginning of this year, in January-February 2025.