In a move that raises panic in the investigation Balance statusCryptocurrency specialists discovered that nearly $9 million had been withdrawn from a virtual wallet that had been inactive for nine months.

This money came from accounts “multiple” – which require multiple signatures to act – only when the legal representatives of the victims requested urgent freezing proceedings before US justice.

Libra condition: Movements detected after months of inactivity

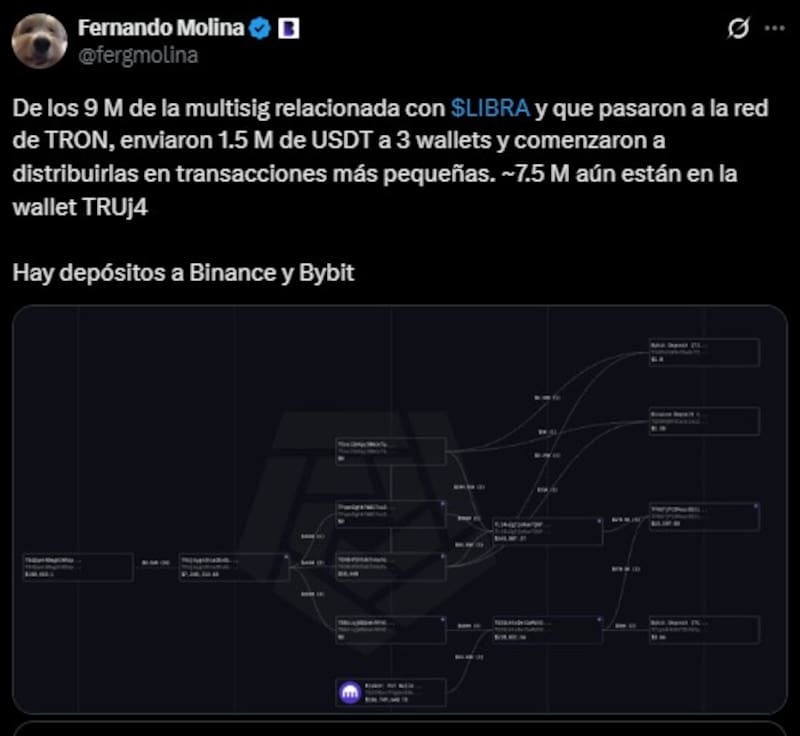

Cryptocurrency expert Fernando Molina It was he who identified suspicious transactions. As detailed on his social networks. 69,000 units of the SOL cryptocurrency (equivalent to about $9 million) were transferred from wallets that had not recorded movements since February 15. past.

The process involved several stages designed to make the research process difficult. The money was transferred from an account identified as “Milei” to another account called “oHtMM”, which later began transferring the funds in smaller batches of 200, 600 and 700 soles to a third wallet identified as “2B7NY”.

The procedure used is typical for those seeking to hide the trace of digital assets. Operators convert SOL tokens into digital dollars (USDC) and send them via the deBridge protocol to another blockchain, where traceability is effectively lost, Molina explained.

Judicial context: Freezing request in New York

These moves occurred at a critical moment in the judicial process in the United States. The Burwick Law Firm, which is representing the victims in the class action, is before a federal judge Jennifer Rochon An emergency request to avoid the “irreversible destruction” of evidence and make it easier to trace the money.

The application warns of impending danger: That the defendants convert traceable funds into privacy cryptocurrencies such as ZCashmathematically designed to erase any trace of origin and destination. According to the court’s presentation, the total amount at risk of disappearing from the radar of justice would reach $94.5 million.

The basis of the order is based on a relevant technical result. Forensic experts discovered a “proof of concept” implemented on November 16, when a wallet linked to the $LIBRA team ran a test: Transfer 1.36 million tokens to SOL and in less than 2 minutes transfer them via the NEAR Intents protocol to a protected ZCash addresscausing the trail to expire and the assets to be permanently untraceable.

Despite the seriousness of the allegation, lawyers for Hayden Davis and Benjamin Chow rejected these arguments as “fallacious,” claiming that they were a repetition of previous requests previously rejected by Judge Rochon.

New plot information: Meetings at Olivos

Meanwhile, MP Maximiliano Ferraro, head of the Libra investigation committee, revealed information linking various government scandals. According to official records, on November 10, 2024, Diego Spagnuolo (then Chairman of ANDIS) and Mauricio Novelli (organizer of the Libra-related technical forum) Quinta de Olivos entered at 6:46 p.m. and 6:38 p.m. respectively, without specifying the date of their departure.

That night was Sunday, and they had both been invited to attend one of the opera evenings that the President organized on weekends with his loved ones. At the time, neither knew of public profiles; Months later, both names would be linked to the Miley government’s most serious scandals: the Libra cryptocurrency scam and the alleged bribery case at ANDIS.

Final report of the investigation committee

The special congressional committee investigating Libra submitted its more than 200-page final report last week. The document specifies that President Javier Miley’s public promotion of these “private actions” was a necessary condition for the completion of the alleged fraud.

he The report finds that the facts analyzed would be consistent with an “alleged fraud.” Political responsibility is assigned to both the president and his sister Karina MileySecretary General of the Presidency. The committee urged Congress to evaluate the president’s alleged “poor performance” in exercising his duties.

Technical analysis of the blockchain identified ownership of the wallets and drew direct economic links between Argentine businessmen Mauricio Novelli, Manuel Terrones Godoy, Sergio Daniel Morales and American Hayden Davis, who held meetings with Miley at Casa Rosada facilitated by Karina Miley.

Background of the case

The scandal broke out on February 14, 2025, when President Miley posted a message promoting the $LIBRA cryptocurrency on his X (formerly Twitter) account. Within a few hours, demand skyrocketed and the price rose from 0.3 cents to $5.54. However, soon after, the value decreased causing millions of dollars in losses.

According to technical analysis, 87 transactions totaling $13.5 million were executed in the 22 seconds preceding the presidential tweet, while 114,410 wallets recorded losses of at least $87 million.

The case has sparked more than 100 criminal complaints in Argentina and multiple investigations in the United States, where a class-action lawsuit that initially sought to freeze nearly $280 million linked to the operation is being processed.