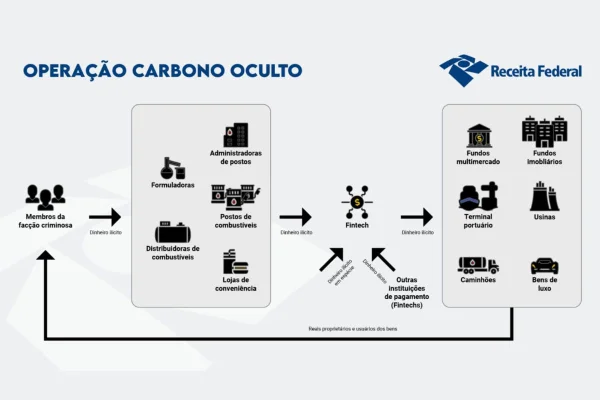

After the closure of fuel distributors targeted by Operation Hidden Carbon, which exposed the relationship between the First Capital Command (PCC) with the fuel sector and Faria Lima, the Refit Group changed its financial structure, according to the Federal Revenue Service. People and companies linked to the group are the targets of a new massive operation on Thursday (27/11).

According to the IRS, the model the company has been using since 2018 has been replaced by another, with new operators and companies. These operators, previously responsible for movements of around R$500 million, will begin moving more than R$72 billion after 2024.

People associated with the Refit group are targets of massive operations

People associated with the Refit group are targets of massive operations

The group led by businessman Ricardo Magro has been identified as the largest ICMS debtor in São Paulo.

This Thursday, 190 search and seizure warrants were executed in São Paulo, Rio de Janeiro, Minas Gerais, Bahia, Maranhão and the Federal District.

How different fraud schemes worked

Through complex financial operations, the group moved more than R$70 billion in just one year, using its own companies, investment funds and offshore companies – including a source outside Brazil – to hide and protect profits. Its financial operations are managed by the same group, which controls financial companies and uses international structures to protect assets.

According to investigations, the importers acted as intermediaries, purchasing naphtha, fuel and diesel from abroad with resources from manufacturers and distributors associated with the group. Between 2020 and 2025 alone, people surveyed imported more than R$32 billion worth of fuel.

11 photos

11 photos

Conditional closure.

Conditional closure. 1 of 11

1 of 11

Hidden carbon process

Disclosure/Federal Revenue 2 of 11

Hidden carbon process

Disclosure/Federal Revenue 3 of 11

Megaoperation is consistent with arrest warrants against schemes at gas stations and fintech companies controlled by the PCC

Disclosure/Federal Revenue 4 of 11

Megaoperation is consistent with arrest warrants against schemes at gas stations and fintech companies controlled by the PCC

Disclosure/Federal Revenue 5 of 11

About 1,000 jobs generated 52 billion Brazilian reals between 2020 and 2024.

Reproduction/Globoplay6 of 11

The massive operation discovered that at least 40 investment funds were being used as structures to hide assets

Reproduction/Globoplay7 of 11

About 350 search and seizure warrants were issued against individuals and legal entities in eight states across the country

Reproduction/Globoplay8 of 11

Financial transactions through fintech companies have made it difficult to track the amounts transacted

Reproduction/Globoplay9 of 11

More than R$7.6 billion in taxes were evaded, according to the massive operation

Disclosure/Federal Police10 of 11

Gas station owners sold their establishments to the criminal group and threatened them with death if they pressed any charges

Disclosure / Federal Police11 of 11

There are indications that stores and bakeries were also involved in the scheme

Detection/Federal Police

The amounts dealt with were concentrated in financial companies controlled by the same group. The Federal Revenue Service identified that a large financial operator acted as a partner for other institutions that also provided services to the group. This base amount transferred more than R$72 billion between the second half of 2024 and the first half of 2025.

The scheme involved a “parent” financial company controlling several “daughters,” creating complex operations that made it difficult to determine the true beneficiaries.

As Operation Hidden Carbon discovered, regulatory loopholes, such as “pocket accounts,” that prevent the flow of resources from being tracked, have been exploited. The main finance company had 47 bank accounts in its name linked to the group’s companies.

Billions of dollars in losses to the public treasury

The court allowed the implementation of precautionary measures in civil lawsuits that seized more than R$10.2 billion of the assets of those involved, including property and vehicles, to guarantee the tax credit.

According to investigators, the scheme caused a loss of R$26 billion to state and federal coffers. The persons and companies mentioned in the investigation are suspected of being part of a criminal organization and committing crimes against the economic and tax system and money laundering.

the Capitals She requested a position from the Renewal Group regarding Thursday morning’s operation and received no response. It remains open for updates.