At this time of year, more than three million self-employed workers don’t know what contributions they’ll have to pay to Social Security next year. This is because the government was unable to conclude an agreement with them … the Self-employed organizations To update payments that are later verified in Parliament. His proposals also succeeded in putting practically the entire parliamentary structure on the brink of war, including its partners. Some like the Junts are preparing their own alternative, after PP introduced its own.

Since October 20, the administration headed by Elma Saez has not met with the group to negotiate a new scheme of departments and shares for the period from 2026 to 2028; This was the last meeting after his ministry had to cancel the planned 35% increase due to strong pressure from political parties and presented a new plan that was also not convincing. He has not taken any steps since then.

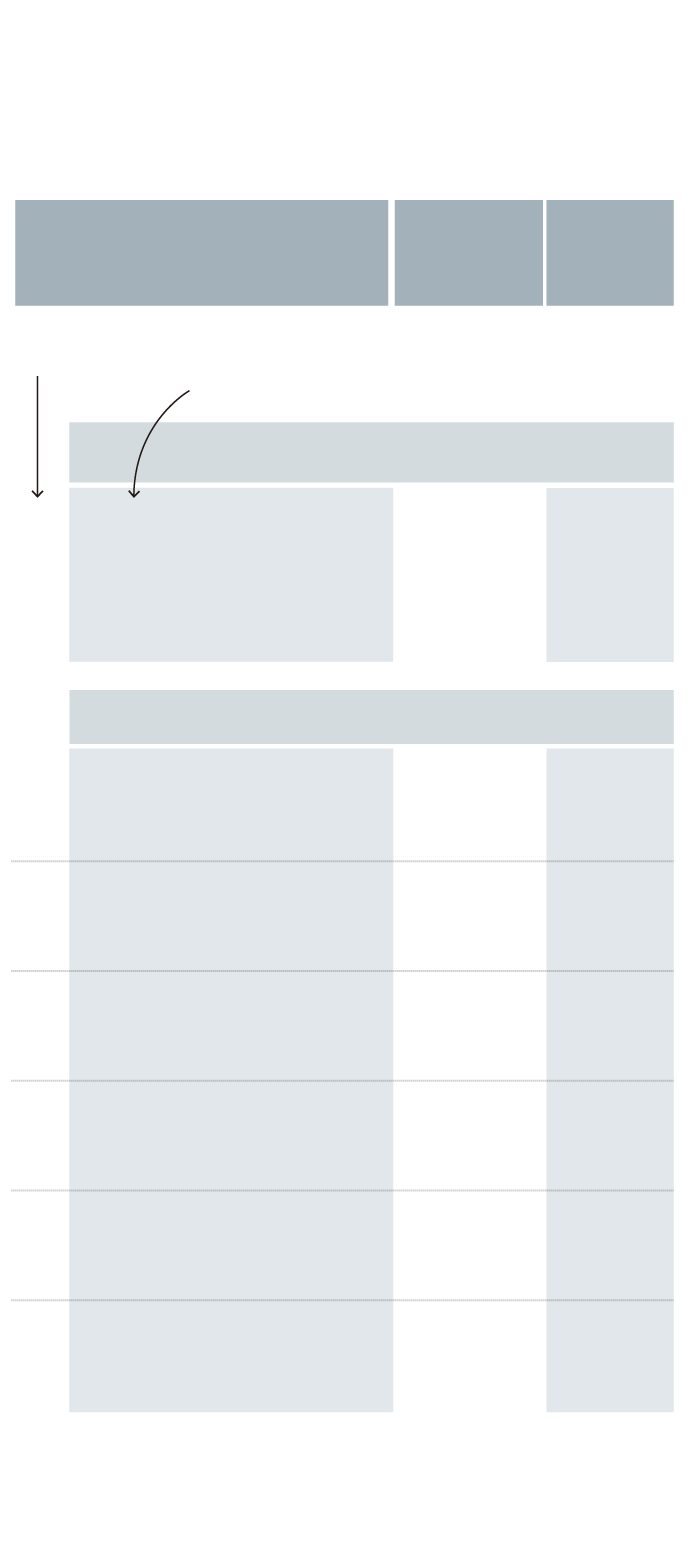

Minimum rules and quotas

Rita in 2025

fountain

Master’s degree in Inclusion, Social Security and Migration

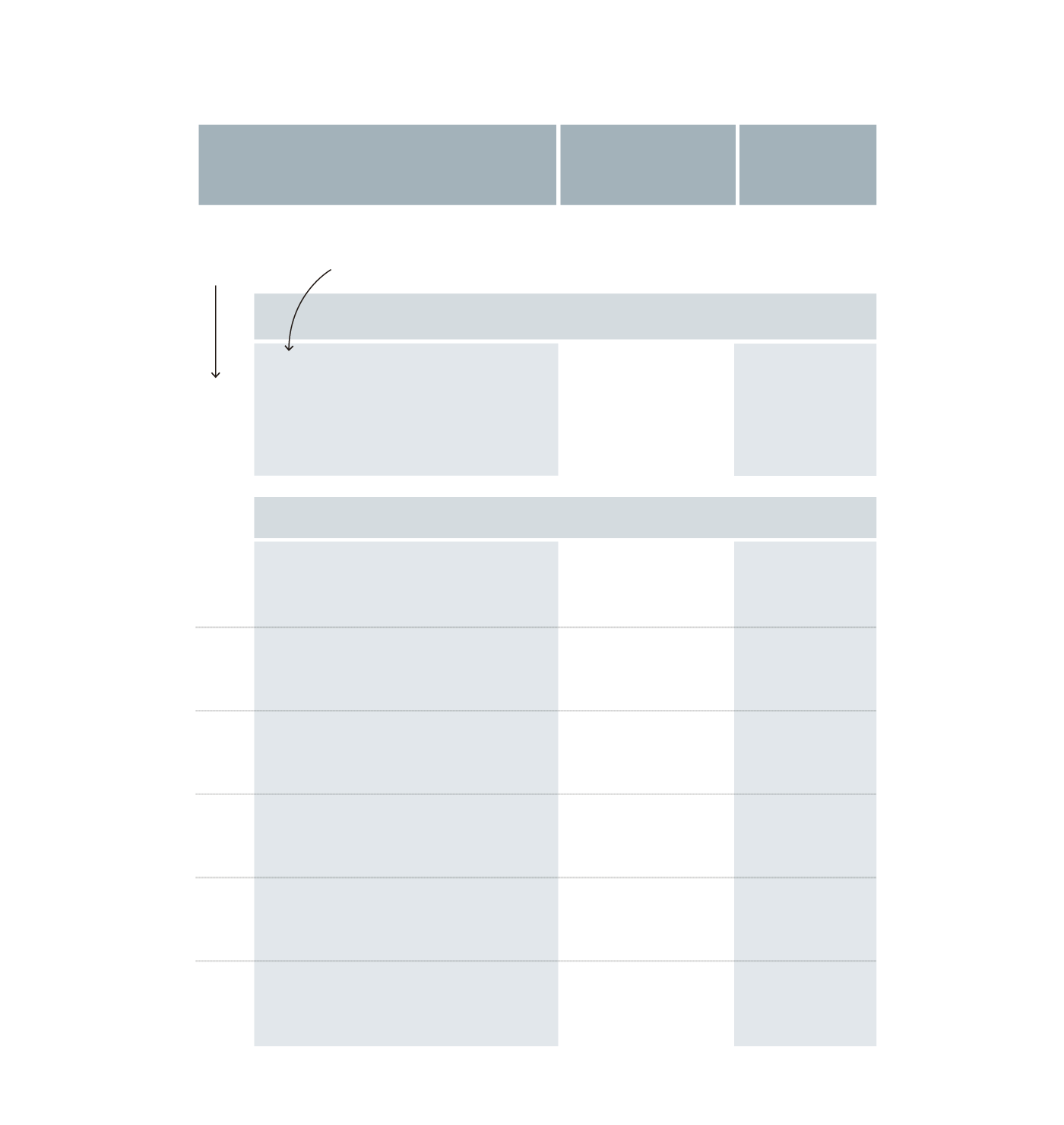

Minimum rules and RETA quotas in 2025

fountain: Master’s degree in Inclusion, Social Security and Migration

Without prior agreement with the associations, investigation Support of the Cortes This is a practically impossible task, and parliamentary calculations do not allow the executive authority to implement its proposals. Everything indicates, then, that the system for self-employed workers to contribute to the system will begin to be frozen in the new year, according to the sources consulted.

The changes in payments for self-employed workers are due to the fact that the government signed up with them three years ago ATA, Upta and Uatae An agreement stipulates that the quotas should be reviewed and updated in 2025 with the goal of arriving in 2032 with a plan that equalizes the contributions of these workers, as well as their benefits, with those of employees.

Launched in 2023, the new system will end the self-employed person deciding, as had been the case until then, how much to contribute to the mutual fund. The free choice of the contributions base was replaced by sections based on the actual declared income. This is a formula that has been practically linked to the problem of excess contributions in the case of: Overtime. Fixing this imbalance is one of the goals of the employers’ association led by Lorenzo Amor.

Pressure from this employers’ association, combined with political rejection, forced Social Security to withdraw from its initial proposal to increase contributions by up to 35%. As an alternative, the executive has put on the table a model to freeze contributions in 2026 for those who earned up to 1,167 euros per month, those included in the first three sections with the lowest returns, the so-called reduced rate. As for the rest of the workers, that is, those with a net income above the minimum wage, he proposed increases of between 1% and 2.5%, which is consistent with those who earn Between €1,167 per month and €6,000.

The offer was light years away from the first approach, with increases for the three million self-employed people, regardless of their income and growth in their shares among… 200 and 2474 euros per month.

Support for those over 52 years old is a red line

But the proposal was also not convincing because it was not accompanied by an improvement in the group’s rights. The executive branch has defended the path of increasing contributions, arguing that they translate into “rights,” because they improve social protection through higher pensions and Unemployment benefitsBut the ATA nevertheless insisted on a “team effort”; He called on employers to comply with the rights and protections and make them equal to those enjoyed by employees.

The red lines of this organization are to achieve improvements such as the unemployment benefit for those over 52 that employees already have as well as the breastfeeding permit for female workers, as well as making the transfer of activity, which is now denied in 60% of cases, automatic… These are some of the proposals that are included in the “comprehensive reform of self-employment” presented by the ATA to political groups, 60 measures whose spirit is less obstacles, more protection, the promotion of entrepreneurship and generational relief.

Popularity takes the lead

The Ministry of Social Security has shown the spirit of negotiation at all times, but in practice it has not taken steps in this direction for more than a month. Meanwhile, the main opposition party took on the bulk of these demands and counterattacked with a “contract” containing ten measures such as not paying fees for… Serious illness leavesMore facilities for post-retirement work and recognition of the benefits of breastfeeding, as well as support for those over 52 years of age, and a commitment not to exceed the maximum scheme base when in multiple activities, among other things.