The shift in direction is very noticeable, It may be as sudden as mood swings usually are And the expectations of Argentines regarding the economy, which often moves from euphoria to suffering, and vice versa.

Suddenly, after the elections and with the support of the United States, the population, which was still holding on to its tendency to shift to the dollar as we have seen in recent months, now seems to be partly more convinced that the government may be able to keep the dollar stable and, after that, the peso will rise at least for a while longer.

cThis is how you see a new indicator published by the University of Saint Martin, which is called the Social Currency Confidence Index, a measurement that attempts to be reflected in the measurement of cHow much is believed in the peso and the dollar according to their use, But it also includes a survey of expectations regarding its strength or weakness in the future. The results were amazing in the November edition compared to October.

“Currency regulates much more than economic exchanges: it regulates relationships of trust between state, society, and the future. In Argentina, where monetary stability has historically been intermittent, Trust in the peso is a distinctive measure of political legitimacy and social cohesion,” they wrote in work led by sociologist Ariel Wilkes.

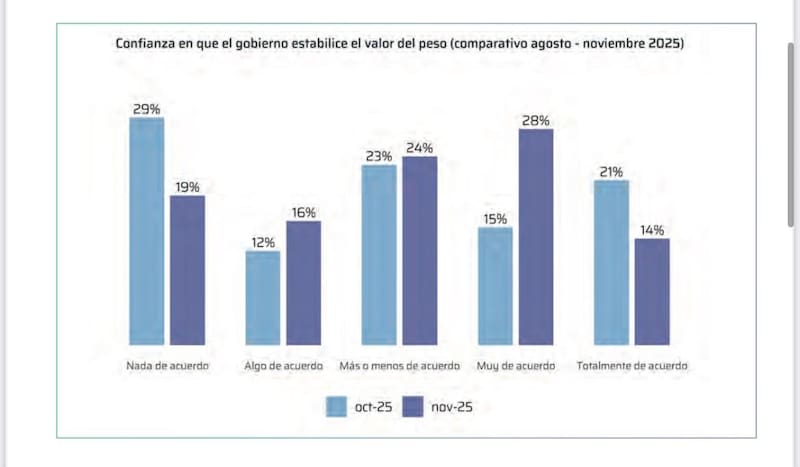

The main novelty of scanning It changes direction in November Compared to October, people’s expectations about the government’s ability to avoid currency devaluation, thus keeping the exchange rate under control and strengthening the peso. Based on a study conducted on 1,117 national cases, 42% of those surveyed agree “very much” or “more or less” with the statement “confidence in the government to stabilize the value of the peso.”While 35% do not trust their ability to achieve this.

In just one month, after the election, the harshest rejection of the idea of overweight drops by 10 points, while the “strongly agree” and “completely agree” categories grow by 6 points, and the action contradicts “indicating a significant movement in public perceptions.” It is as if the election, combined with the support provided by the United States, has raised doubts among at least some of those consulted about the sustainability of the exchange rate in the short term.

Expectancy has strong differences by age and gender. Although the men surveyed showed a very significant decrease in strong pessimism and an increase in moderate optimism, it was women who made the biggest jump in the “strongly agree” option with the government to strengthen the peso.

Moreover, they are people who tThose between the ages of 30 and 59 reported a greater increase in strong optimism than othersWhile those over the age of 60 became the most optimistic age group, with the greatest growth in “full agreement” with the idea of keeping the dollar under control and strengthening the national currency.

Pay for the future

Meanwhile, the index of social confidence in the currency for November shows an indicator of 2.90 points out of 5, confirming the scenario of “fragile stability,” as the work indicates, that is, “in which the peso functions for daily life, but doubts remain about its future value.”

Index It is composed of four basic dimensions: Expectations of the future value of the peso; Relying on the peso as a store of value; Relying on the peso as a unit of account; And trust in the peso as a means of payment.

“The partitioning reveals a markedly asymmetric structure,” the document warns. Value expectations continue at low levels (2.92). The confidence of the peso as a store of value is even lower (2.53), and constitutes the “main constraint” of the index.

On the other hand, transactional functions received a score of 3.70, and as a means of payment a score of 3.91. “In sum, the currency retains operational legitimacy for payment and account, but severe doubts remain about its ability to maintain value over time and achieve future stability,” the analysis concludes.

The study compares confidence in the peso and the dollar according to the functions each currency performs in the Argentine economy. The results confirm the stability of monetary duality: The dollar surpasses the peso as a reserve of value (3.21 vs. 2.53) and the peso largely dominates as a unit of account (3.70 vs. 2.78) and means of payment (3.91 vs. 2.46).

“So the weight Organizing daily life“While the dollar remains a reference for savings and protection in the face of uncertainty,” it was specified. He continues: “Instead of ‘competition’ between currencies, there is a distribution of tasks: the peso regulates daily life and the dollar regulates the relationship with the future.”

In fact, the tendency to dollarize has not stopped at all this year, but since stocks opened in mid-April, the purchase of foreign currencies for hoarding has exceeded US$29 billion according to central bank data, generating the paradox that while people “trust” that the government will strengthen the peso, they also take the opportunity to add dollars as if they know that it will never last forever.

One of the clearest expressions that make the dollar always the champion in the minds of Argentines is the advertisement that we see these days on public roads about the final season of… Strange thingsWhich says “When we met once – the protagonist – a dollar was worth 14 dollars.” The series began in 2016. Another chapter when the book “The Dollar, a National Currency” is republished, written by Mariana Luzi and specifically Ariel Wilkes, author of the study included in the memo.