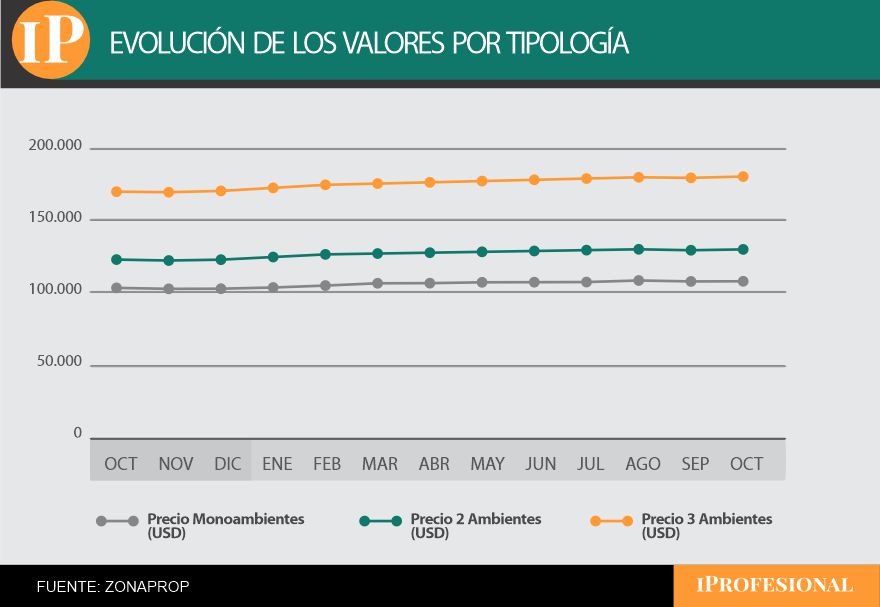

Last year the values of Departments in the The City of Buenos Aires (CABA) has seen an upward trend: the average square meter now costs $2,450, an increase of 5.4% compared to last year. But not all segments moved in the same way: Studio apartments were among those who moderated their posts the most Prices: rose by 5.11% in the year dollar between October 2024 and October 2025 from $102,226 to $107,493, according to data provided by Zonaprop iProfessional.

The largest such monthly jump was recorded in February 2025 with an increase of 1.20%. However, from July onwards, prices reached a plateau: fluctuations were minimal and barely amounted to 0.51%. between July and August. The explanation for this more moderate development lies in the significantly lower demand. “It is aimed primarily at young people and those looking for their first home or a low-cost investment,” explains Leandro Molina, country manager of Zonaprop.

This behavior reflects the market’s caution in the face of economic uncertainty Favoring larger or more profitable unitswhich keeps the pressure on large typologies and slows down the pace of studio apartments. In addition, investors are “not choosing them as frequently as they used to, and the end buyer – who now controls a large part of the market – is prioritizing larger units,” says Ezequiel Wierzba, CEO of Click.

Which departments are seeing the biggest increases in the city?

Like the studio apartments, the apartments two environments They also saw an increase over the previous year, although slightly larger: 5.21%driven by a significant acceleration between January and March 2025, a period in which they gained 2.58%.

The units of three environmentsinstead, consolidated themselves as the most dynamic segment of the Buenos Aires market: they grew 5.83% last year. “Values passed of $169,082 in October 2024 AU$178,937 in October 2025, with the highest monthly growth concentrated between January and March 2025, when prices rose by 2.32%,” explains Molina.

One of the main reasons for this dynamic is that the greatest demand is concentrated in two-bedroom apartments. “Families with one or two children, couples who want to expand, or families who need to downsize,” says Altgelt. Added to this is the scarcity of quality supply in this segment: “When demand is high and supply is limited, this leads to higher prices, especially in central areas with good connectivity,” he adds.

Development of prices for studio apartments, 2 and 3 bedroom apartments

Reality confirms this trend. ““There is high demand and low supply of quality, and when that happens, prices rise faster,” Wierzba clarifies. In addition, this target group – families, established couples or those leaving a two-bedroom apartment – “is usually willing to buy and less price sensitive. All of this leads to a faster rate of increase than the other typologies.”

Studio apartments: what to expect from prices and opportunities for investors

Analysis by typology shows that while all segments are seeing growth, the largest units are the ones making the fastest progress. This gap opens a window for those looking to invest in studio apartments that still have relatively affordable values and room for appreciation in the medium term.

In the short term, this segment is expected to maintain a moderate growth rate. However, If the share’s absorption continues and investment demand is activated again, experts do not rule out a recovery by 2026. Meanwhile, momentum for studio apartments will continue to slow as demand today skews towards larger units and there are no new incentives for retail investors.

They could only gain traction if profitability improves, investor interest rates rise, or supply decreases in certain areas. The trend remains stable for the time being. Even so, Today’s price difference makes studio apartments an attractive choice. “They have fallen in value and that opens an interesting window,” says Altgelt.

Although their values continue to be more accessible and move less dynamically than other typologies, this is the case medium-term appreciation potential if the market recovery is confirmed. They are not the most sought-after product at the moment, but precisely for this reason they can become a strategic entry point for those who think about the future and want to buy in an environment of still limited prices.

In short, studio apartments represent an interesting alternative for those who want to enter the market at cheaper prices and with a vision for the future. “Some areas, such as Palermo, Colegiales and Chacaritaas well as neighborhoods with impending development – for example The fatherly– still show room for value appreciation in the short and medium term,” concludes CEO of Click.