The municipality of Pilar has decided to increase tax pressure at the supermarket checkout by applying the law Environmental protection quota of 2%, which applies to large chains since December 1st and affects the final price of the products. According to tax officials, the decision directly affects the purchase receipt and means that those who shop in Pilar will have to pay 2% more for the products. In this context, Minister of Economy Luis Caputo took direct action against the municipality by warning consumers: “Do not buy in Pilar.”

Caputo will return to dollar debt markets to settle maturities

The minister continues his crusade with the increase in local taxes since then September 2024 as the controversy resurfaced following the increase in municipal taxes in several municipalities in the suburbs of Buenos Aires. Caputo criticized these increases – arguing that many tariffs are not proportional to the services provided – and accused mayors of “hindering the reduction of inflation.” Already in January of this year, the conflict escalated and the head of the Ministry of Finance formalized his offensive, sending a letter to the 23 governors asking municipalities to lift tariffs that he considered “illegal or arbitrary.” In response more than 500 mayors signed a collective denial document in which they accused him of a “Unconstitutional push for local autonomy”.

“The only thing they can do”: Luis Caputo targeted a municipality for raising a tax rate

Now the minister with the cap came out to persuade the mayor of Pilar Federico Achával, who applied The Environmental protection rate that directly affects consumers’ bills.

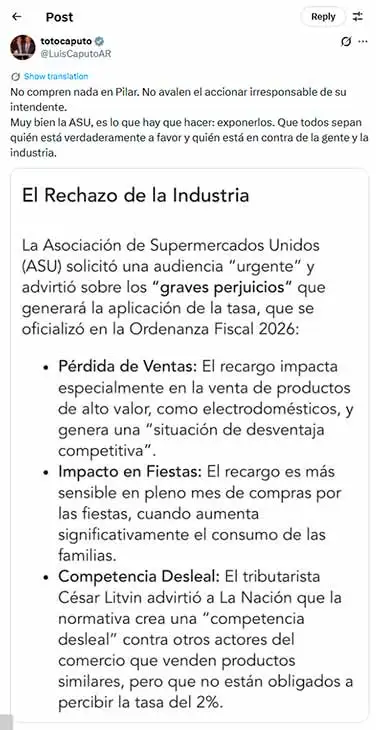

“Don’t buy anything in Pilar. Don’t support your mayor’s irresponsible actions. Very good.” ASUis what you need to do: expose them. “Let everyone know who is really for the people and the industry and who is against them,” said the economic chief.

What has changed in Pilar

The municipal tax, which previously levied a fixed amount, was changed by the Tax Ordinance 2026. Status: December 1, 2025the rate is calculated as 2% VAT on the net amount every purchase in supermarkets and hypermarkets instead of the modular system.

The measure also includes large companies, shopping centers, hotels, industrial establishments, services and some private companies designated as debt collection agencies.

Municipality of Córdoba: Until the end of the month you can join the debt settlement system

Trade associations – like that Association of United Supermarkets (ASU) and CADAM – questioned the tariff, warning that it will make buying tickets more expensive, will particularly affect high-value products and could distort competition against companies not covered by the tariff.

The industry’s rejection of the increase in municipal tariffs

The Association of United Supermarkets (ASU) requested an “urgent” hearing and warned against it “Significant damage” This leads to the application of the rate officially established in the Tax Regulation 2026.

Loss of sales: The surcharge particularly affects the sale of high-value products such as household appliances and leads to a “competitive disadvantage”.

Effects on parties: In the middle of the Christmas shopping month, when family consumption increases significantly, the surcharge becomes more noticeable.

Unfair competition: Tax expert César Litvin warned La Nación that the regulations lead to “unfair competition” against other commercial actors that sell similar products but are not required to pay the 2 percent tax rate.

The sector requested that the entry into force of the measure be extended until March 1, 2026 if the municipality maintains the measure in order to allow the collection systems to be adapted.

lr/fl