The government announced a permanent reduction in tax withholdings for major crops as part of a phased process, subject to fiscal targets

12/09/2025 – 10:21 am

:quality(75):max_bytes(102400)/https://assets.iprofesional.com/assets/jpg/2025/07/600264.jpg)

The nation’s economic minister, Luis Caputoexpected a permanent reduction in “the path to fiscal relief for the agricultural sector”; In September it temporarily abolished this to accelerate the inflow of foreign currency and strengthen the central bank’s reserves.

The decision adds to other cuts made by the Libertarian government, which had already temporarily abolished it Withholdings September, a measure that brought in $7 billion in revenue amid strong exchange rate tensions.

The government announced a further reduction in tax withholdings for rural areas

Detailed list of measures and key points

1. Changes in withholding tax rates

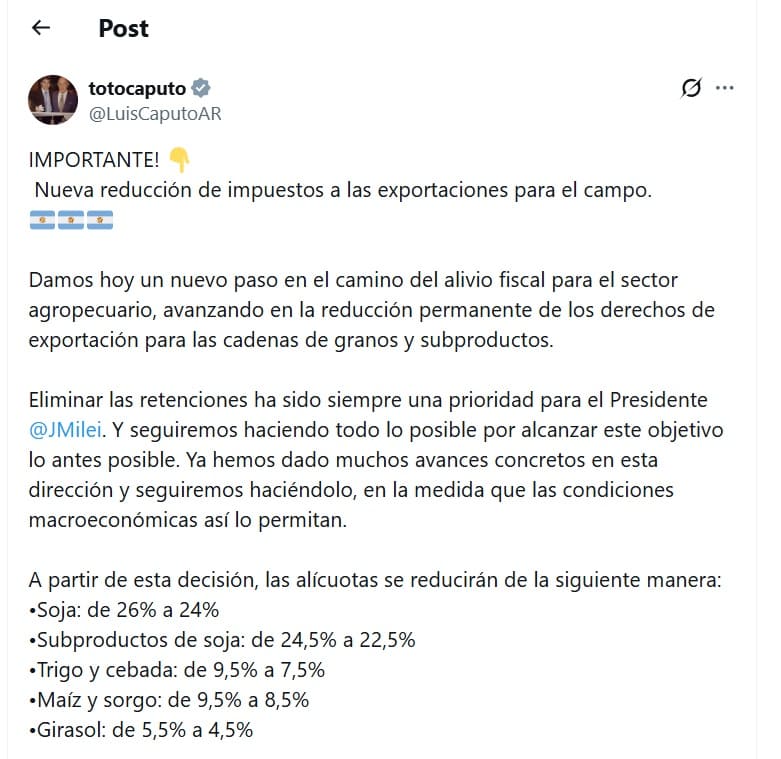

The government announced a reduction in export tariffs for various agricultural products. The new tariffs are as follows:

- Soy: from 26% to 24%.

- Soy byproducts (flour and oil): from 24.5% to 22.5%.

- Wheat: from 9.5% to 7.5%.

- Barley: from 9.5% to 7.5%.

- Corn: from 9.5% to 8.5%.

- Sorghum: from 9.5% to 8.5%.

- Sunflower: from 5.5% to 4.5%.

2. Official objective of the measure

- Authorities claim the cut is part of a step by step process The aim is to permanently reduce export tariffs.

- Minister Luis Caputo stated that the long-term goal is this Eliminate withholdingsdue to macroeconomic developments.

3. Economic justification expressed by the government

- Caputo noted that the measure was intended to do just that Improving the competitiveness of the agro-industrial sector.

- According to official information from the minister, the agro-industrial complex provides about 60% of exports of the country.

- The reduction aims to impact the costs and margins of the export sector.

4. Macroeconomic conditions

The government said further cuts would depend on the following factors:

- Collection development.

- Compliance with tax objectives.

- General macroeconomic situation.

5. Immediate precursor

In September the government requested a temporary elimination of withholdingswhich produced the following:

- An estimated income of $7 billion of the agro-export complex.

- A contribution that, according to the executive, was relevant at a time of tension in the exchange.

6. Sectoral scope

The measure affects the country’s most important exportable crops. Effects on:

- Soy complex.

- Grains such as wheat, corn, barley and sorghum.

- Oilseeds such as sunflowers.

The changes affect the commercial and production planning of each chain.

7. Tax and Economic Impacts

The Ministry of Economic Affairs has not yet published any estimates of the fiscal impact.

Analysts note that the reduction in tariffs could mean:

- Lower tax revenue in the short term.

- Possible future compensation through higher export volumes.

8. Connection with general economic policy

Reducing withholding tax is part of a broader strategy aimed at:

- Reformulate the tax structure.

- Promote exports.

- Maintain budget balance.

- Gradually review taxes related to foreign trade.

9 Importance of the agro-industrial sector

The government emphasizes agriculture as a central component of Argentina’s foreign trade.

Tax decisions in this sector are considered relevant to:

- Activity levels.

- The creation of currency.

- Planning the next agricultural campaign.