- Labor reform: one by one, the tax changes proposed in the text

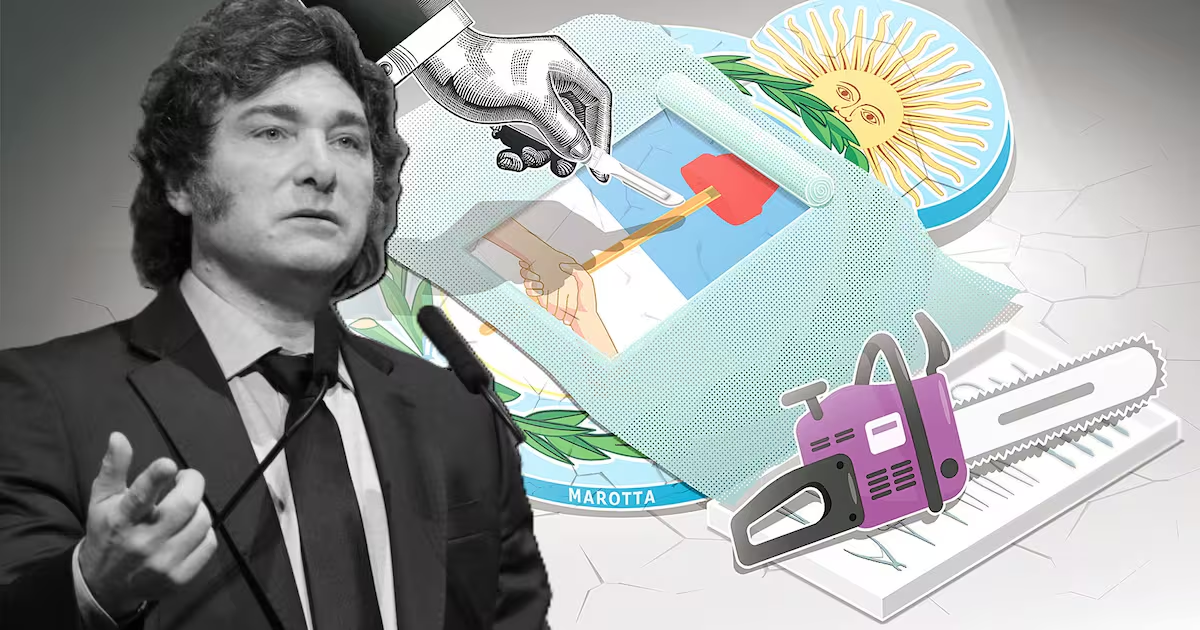

He Government officially presented Ambitious project to “modernize the world of work”.who moved in for proper treatment during the Congress extraordinary meetings (valid until December 30th).

The Labor reform establishes a new regulatory framework, particularly in the Modernization of current labor regulations: Vacation, compensation (new system: work assistance fund -FAL-), layoffs and the organization of working hours (hour bank)among other things.

In a message released this morning confirming the deployment of the project, the Chief of Staff stated: Manuel Adorniemphasized that the proposal “represents the biggest change in Argentine history in labor matters“.

The text, created by the May Councilwhich was attended by Adorni himself, legislators, governors, businessmen, industrialists and union representatives, also added a section on a number of tax changes.

Specifically, the initiative has one Reducing income tax for companiesThe Abolition of internal taxes for cars, a “relief” from the burden Value Added Tax (VAT) for the agro-industrial sector and the decline Employer contributions.

Labor reform: one by one, the tax changes proposed in the text

Although the project’s focus is on “modernizing the workforce,” the government also added some important guidance on tax treatment.

Income tax

First, the text suggests: a Reducing income tax rates for companies.

“The progressive corporate income scale will be modified to focus on the final two (2) sections of the scale an aliquot of twenty-seven percent (27%) and from thirty-one point five percent (31.5%) From years beginning January 1, 2026, This represents a ten percent (10%) reduction in applicable rates compared to current levels“This strengthens the incentive to reinvest profits and creates more competitive conditions at the regional level,” the project says.

In summary, this means that the win rate has an impact Large companies and/or small and medium-sized enterprises (SMEs)is reduced from 30% to 27%, while the upper range drops from 35% to 31.5%.

In addition, the initiative introduced income exemption for Rental and real estate sales.

“Adjustments are being introduced to eliminate distortions and simplify the treatment of people by exempting from tax the consequences of the alienation of immovable property and the transfer of rights to immovable property from January 1, 2026.”

There is even a special treatment for it Transactions related to negotiable securities (whether or not they are listed on government-approved markets National Securities Commission (CNV).

The aim is to “promote the development of the capital market and encourage the redirection of savings into productive investments”.

Employer contributions

The labor reform is also aimed at reducing Employer contributionsi.e. the tax burden that entrepreneurs bear.

So what you are looking for is “rationalize employer contribution rates which are intended for and integrate social security subsystems seventeen to forty percent (17.40%) for Larger employers in the service or retail sector and in fifteen percent (15%) for the rest of the private employerswhich strengthens the competitiveness and progressiveness of the system based on size and activity.”

However, the project also mentions the possibility of reducing “the employer contributions that have already been registered”, “The compulsory contribution to the national health insurance system is five percent (5%).”.

Internal taxes

Another topic that the Work Modernization Act covers is the Abolition of internal taxes. “The project makes progress in cleaning up taxes that have shown little functionality and operational complexity, eliminating those that hinder competitiveness, administrative efficiency and the development of dynamic sectors,” the regulations say.

In this sense, the executive proposes the abolition of these taxes “that raise taxes Insurance items, luxury items, motor vehicles and engines, recreational or sports boats and aircraft and other insured goods“.

In addition, the initiative would like to “reorganize the system related to audiovisual activities and abolish fees for cinema screenings and videograms”.“.

What the administration wants President Javier Milei is to stay in the with these suggestions Path of simplification and regulatory order. This includes eliminating distortions, eliminating impacts, standardizing criteria, ensuring the neutrality of the system and simplifying and reducing compliance costs.

“This process is guided by a non-negotiable principle: maintaining the budget balance that has taken so much effort to achieve,” they noted.

VAT exemption for rural areas

The government intends to grant approval with the aim of “restoring systemic competitiveness”. “special treatment in VAT”.

The truth is that, as the project states, the measure would only be intended “for the…” electrical energy applied to Irrigation systems of the agro-industrial sector“, since in this case relief is sought Reduce costs and promote the adoption of efficient technology.

Work modernization law project. VF. PDF from Cronista.com