Currency erosion: how the silent tax works

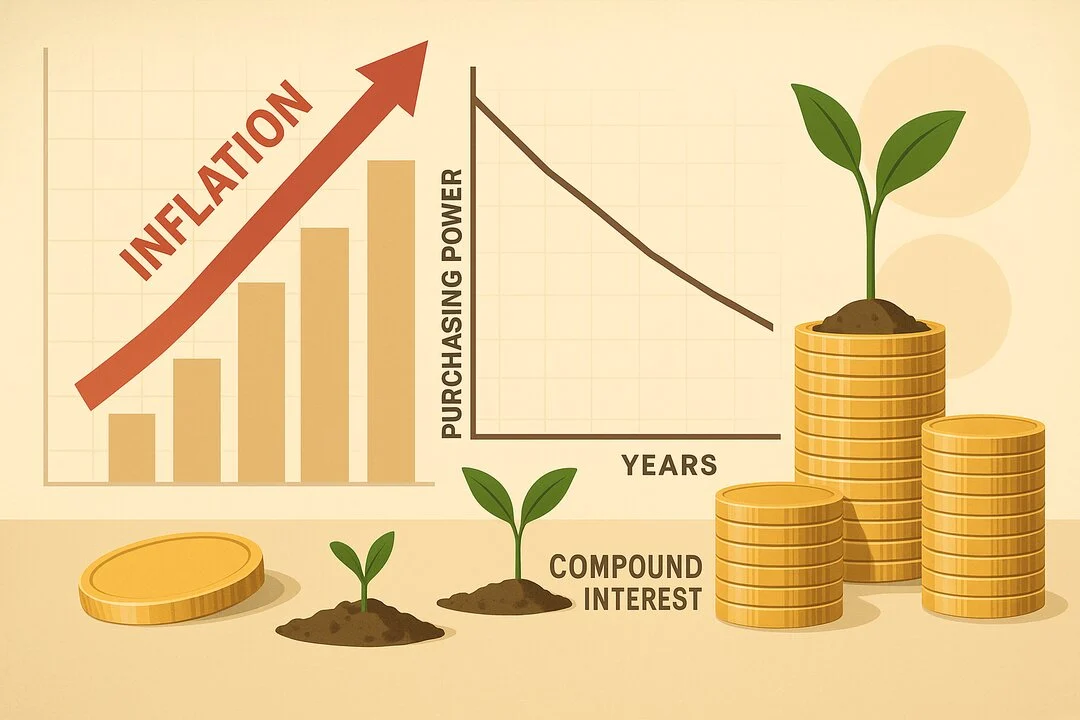

Inflation acts like an invisible tax that reduces the real value of money year after year. Although the CPI is the most widespread benchmark for measuring this price variation, its scope is partial, since it does not include assets such as housing or certain assets that affect the calculation of the cost of living. This indicator nevertheless makes it possible to observe the extent of the deterioration in purchasing power over time.

When inflation remains at levels considered moderate, such as 3% per year, the cumulative impact is surprising. The effects are clearly seen when these figures are transposed into medium and long-term scenarios, where depreciation multiplies. This is when a significant gap appears between the nominal value of savings and their real purchasing power.

Data that changes the perception of savings

At 3% annually, 100,000 euros lose more than a quarter of their value in ten years, remaining at the real equivalent of 74,409 euros. The figure is even more revealing when we extend the period: in twenty years, purchasing power drops to 55,368 euros; in thirty years, 41% of the initial value; and in their 40s, only 31%. These estimates do not take into account the increase in the cost of assets such as housing, the evolution of which is generally more intense than that of current consumption.

This accumulated loss explains why keeping large sums of money uninvested can create a false sense of security. The stability of the figure in the bank account does not reflect the silent erosion that inflation causes in its real value.

The tool that compensates for inflation: the effect of time

Faced with the constant depreciation of fixed savings, compound capitalization is presented as the most effective response to regain ground. This financial mechanism, commonly known as one of the wonders of wealth growth, works through the reinvestment of the interest generated. Thus, returns produce new returns, accelerating the increase in capital.

The key to this process lies not only in the profitability obtained, but in the variable that most improves the long-term result: time. The longer the investment horizon, the steeper the growth curve.

The difference a decade makes

A practical example, reported by elEconomista, illustrates the decisive weight of the time factor. If a person starts saving at age 25, contributing 5,000 euros per year with a return of 5%, at age 65, they will accumulate more than 669,000 euros. If another person, with identical contributions and profitability, begins this effort at age 35, the final capital will be 370,000 euros.

A third person who waits until age 45 to start regular savings will reach around 186,000 euros at age 65. The direct comparison leaves an unequivocal message: ten years apart almost doubles the final capital; Twenty years multiplies it by more than three.

Equal contributions, very different results

The analysis of total contributions reinforces this conclusion. Anyone who started at 25 will have contributed 200,000 euros and generated 469,000 euros in interest, or more than double their capital. Anyone who starts at age 35 contributes 150,000 euros and obtains 220,000 euros in interest. Those who start at 45 pay a contribution of 100,000 euros and only generate 89,000 euros in returns.

The disparity is not due to the annual amount, but to the time of exposure to capitalization. Growth is not linear, but exponential, so the additional years provide a benefit that is difficult to compensate for later, even by increasing contributions.

Periodic savings as an economic defense

In a context where inflation maintains constant pressure on purchasing power, periodic savings becomes a tool capable of mitigating part of its effects. The combination of discipline, reinvestment and time helps counteract the silent depreciation of money, especially when it begins in the early stages of professional life.

The real impact of inflation, combined with the potential for the situation to get worse, reveals a clear conclusion: starting earlier makes a difference. Time, rather than the amount paid, is the most valuable financial resource for protecting and growing wealth against continued loss of the value of money.