Last week the government ordered a new cut in export tariffs, better known as withholdings, on major grains. Although the measure was welcomed by the entire agricultural sector, its impact would be limited both in terms of foreign exchange earnings and producers’ margins.

The aliquots are modified as follows: for the soy it increases from 26% to 24%, and for its by-products it decreases from 24.5% to 22.5%, Wheat And barley Decrease from 9.5% to 7.5%, corn And Sorghum from 9.5% to 8.5% and for Sunflower from 5.5% to 4.5% percent.

The Minister of Economics, Luis Caputo, He emphasized that “this reduction in withholding tax aims to improve the competitiveness of the agricultural industry, one of the strongest engines of the Argentine economy and responsible for almost 60% of our exports.”

We reiterate our belief that the Argentine landscape will continue to grow, create jobs and promote development in every region of the country (Caputo).

In this way, Caputo stated: “We reaffirm our belief that the Argentine countryside will continue to grow, create jobs, promote development in every region of the country and strengthen Argentina’s presence in global markets.”

The Rosario Stock Exchange (BCR) highlighted that with this reduction, the soybean complex price remained at its lowest level in almost 19 years.

The agricultural advisor Javier Preciado Patino He said: “One of the reasons why the government has taken this decision now is that settlements are very low after the ‘soybean dollar’ in September. The exchange rate stability in recent weeks has been explained by the ONs introduced by the private sector, particularly energy companies, and by some debt placements by the provinces.”

There is uncertainty among analysts about whether this relief will be enough to sustain the situation in the summer, when demand for foreign currency for foreign travel increases.

It seems that the government has tried to send a signal to rural areas to improve prices and boost sales in the first months of 2026 (Preciado Patiño).

Preciado Patiño added: “The impression is that the government wanted to send a signal to rural areas to improve the price and boost sales for the first months of 2026. A concrete fact is that the export balance of the soybean complex for January and February is below average.”

He said about the political discussion Infobae: “The other point, already in the area of hypotheses, is whether this measure will not also contribute to facilitating the approval of the 2026 budget. It would be a gesture towards Córdoba and Santa Fe, where the discussion about retentions is always present.”

On his part Mariela Brandolina grain markets and financial investment consultant, said: “Although it is good news a priori, it would not have a significant impact on domestic prices or foreign exchange earnings. Reducing export tariffs improves theoretical solvency by about $4 for wheat, $2 for corn and sorghum, $8 for soybeans and $4 for sunflower.”

Reducing export tariffs improves theoretical solvency by around $4 for wheat, $2 for corn and sorghum, $8 for soybeans and $4 for sunflower (Brandolin).

“Given that buyers have already confirmed levels above theoretical capacity – with the exception of wheat – I don’t expect any relevant change in the pace of marketing. “Even for soybeans, which would benefit the most, it is difficult for us to see a significant recovery in sales as trading flows were already high in previous months,” the specialist said.

According to the BCR this is required The market is pricing in 27.2 million tons of soybeans and corn from the 2024/25 campaign, which is about 1.5 million tons $7,084 million according to current FAS valuation (price of a grain before loading on a ship). On the wheat side, which has just started the 2025/26 cycle, there are still about 18.6 million tonnes left $3,016 million.

Carlos SteigerDirector of the Center for Agribusiness and Food at Universidad Austral, said: “The reduction in withholding tax will not affect the FOB price, which depends on Chicago and a local premium. What may happen is that sales of crops in Argentina will be accelerated and dollars will arrive earlier, as was the case before the elections with zero withholding taxes.”

A report from the aforementioned study house points out that “the government’s decision has led to an ambiguous reading in the market: although the aim is to improve competitiveness, the actual impact is limited.”

Roman DanteProfessor and researcher at the university, said: “Today the industry should have positive margins between $10 and $12 per tonne, but it remains in negative territory.”

Today the industry should have positive margins between $10 and $12 per ton, but it remains in negative territory (Romano)

On the way to new harvestforecast margins are $20 to $30 per ton, but grain still shows losses between $5 and $10. Romano warned: “It is not appropriate to expect a linear transmission of the tax cut to the price because the The market is always defined by supply and demand“In addition, it is necessary to know the fine print of the decree to know whether it is temporary or whether it is conditional. “At the moment the measure has little taste,” he concluded.

According to the Argentine Institute of Financial Analysis (Iaraf), the reduction in export tariffs would represent a direct cost to public budgets of about $570 million.

When thinking about a possible increase Collection of income tax Given the distribution of co-participation, the budgetary cost falls to $520 million, equivalent to $704.6 billion and 0.08% of GDP. Meanwhile, the provinces and CABA would receive $66 million.

“Depending on the degree of elasticity of supply, the percentage of export duties collected is determined. In an extreme case, the reduction can be completely offset. That is, the increase in production can increase the tax base and compensate for the reduction in the tax rate,” Iaraf estimated.

The fiscal cost falls to $520 million, equivalent to $704.6 billion and 0.08% of GDP. Meanwhile, the provinces and CABA would receive $66 million (Iaraf)

The President of Iaraf, Nadin Argañarazassured that with the announcement the government “will certainly seek to change expectations to boost production and ensure that tax costs are zero.” He also emphasized that there are other factors that could influence the future, such as: climatic conditions and the development of international prices.

The BCR stated: “The reduction in tax rates for the main cereals and derivatives will have an impact of $511 million in 2026, so the revenue for this concept under the new system will be an estimated $4,809 million, a decrease of 10% compared to what was forecast in the previous scenario.”

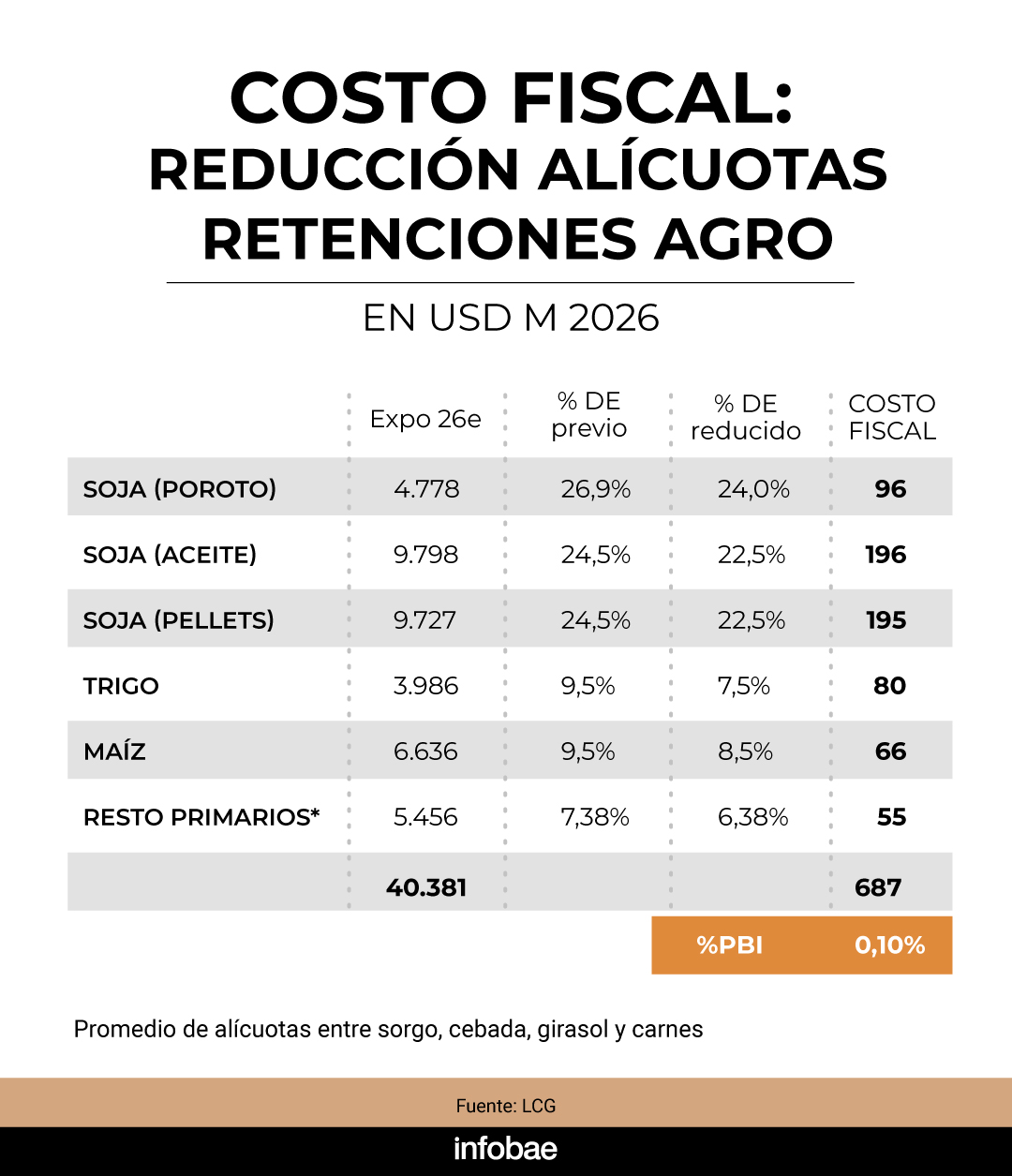

LCG estimated that the fiscal cost of partially eliminating withholding tax in 2026 would be $700 million, equivalent to 0.1% of GDP. “This is in contrast to the projections the executive branch included in the 2026 budgetwill soon be discussed in Congress. It is assumed that tax revenues would increase from 0.95% to 0.98% of GDP between 2025 and 2026,” emphasized the consulting firm.

In this project, “the government committed to achieving a primary surplus of 1.5% of GDP in 2026. This implies a ‘relaxation’ of 0.1 percentage points compared to the self-imposed target for this year. With this measure, this fiscal relief would already be included,” he explained.