Now, this immediate reaction seems to ignore two crucial realities: andthe enormous weight of the inheritance received by Murtra and the need to increase a strategy that aims to put growth first and the generation of long-term value through the distribution of short-term dividends.

To understand the operator’s new strategy, it is essential to contextualize it in the legacy received: a complex financial equation, with high debt, destruction of shareholder value and an excessive dividend policy.

When Pallete took command of Telefónica, The company’s net financial debt was around 50,000 million euros. It reduced it by around 22 billion euros, but that “heroic”the effort was insufficient.

At the end of his mandate, it stood at a level of 2.8 times EBITDA, much higher than that recorded by the sector average, and the value of the cut was lower than the destruction of the stock market value recorded by Telefónica during his time, 57 percent.

When Pallete took command of Telefónica, The company’s net financial debt was around 50,000 million euros

His successor, therefore, does not have the capacity to carry out strategic acquisitions or accelerate the implementation of new generation technologies without putting Telefónica’s credit rating at risk.. The EBITDA target of 2×5 is in line with its European peers.

To come full circle, the dividend policy was excessive. In practice, a tactical financial marketing maneuver designed to hide the collapse of shares and maintain shareholder confidence in the short term, but at a high cost.

On the one hand, it diverted billions of money that could have brought debt relief to optimal levels; On the other hand, it forced the company to constantly depend on asset sales to support both debt and dividends. This ‘financial bicycle’ decapitalized Telefónica and perpetuated a vicious circle whose breaking was essential.

And what to say Flat Transform and grow presented this week?

To begin with, it is an honest response to the reality described. It is prioritized a restructuring strategy to return to growth anchored in financial discipline and operational efficiency, even at the cost of sacrificing immediate shareholder profitability.

Among its main strengths is Telefónica management’s commitment to reducing leverage, which combined with the reduction in CapEx in sales, will translate into lower financial risk and greater flexibility in the future.

The market punished the most visible decision of this approach: the dividend reduction. However, this is a basic act of responsibility to free up money for domestic investment and reduce debt, strengthening the balance sheet in the long term.

On the other hand, Telefónica made clear its decision to focus on four markets: Spain, Germany, United Kingdom and Brazil. This focus allows the group’s operating model to be simplified, gives countries greater autonomy and concentrates management efforts.

A cleaning strategy is prioritized to return to growth anchored in financial discipline and operational efficiency, even at the cost of sacrificing immediate profitability for shareholders.

Simplification is not just an accounting exercise, but a lever to generate concrete and measurable operational efficiencies, with the aim of achieving gross savings of up to 3 billion euros by 2030, which will come from the digitalization of processes, the closure of old networks and the rationalization of structures.

Murtra’s plan recognizes that growth can no longer depend solely on traditional lines of business (connectivity). Therefore, The strategy focuses on scaling business (B2B) and technological services through Telefónica Tech.

Investment in cybersecurity, clouds and artificial intelligence becomes a transversal axis, not only as a differentiating service offering, but as a tool to improve internal efficiency and the customer experience.

In this way we seek capture higher margins and generate more stable revenuesaway from the price war in the retail market (B2C). Revenue and EBITDA growth objectives are similar to those of other major European telecommunications companies.

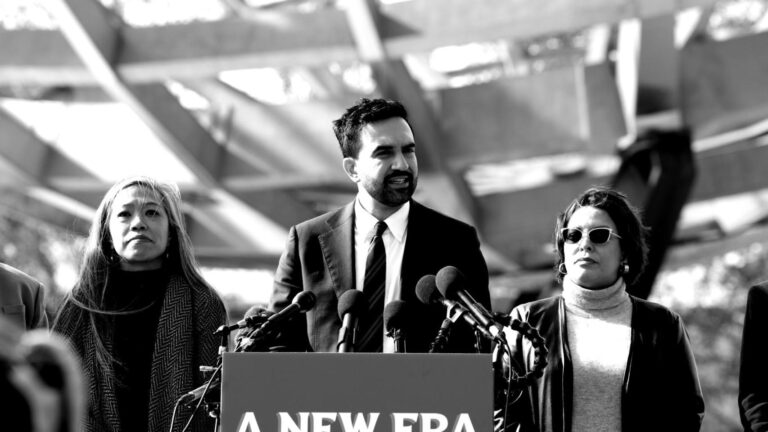

Marc Murtra, CEO of Telefónica, at Capital Markets Day (CMD) 2025

Telephone

But Telefónica’s new strategy is not just to be efficient in its main markets, but to become a catalyst for the necessary market consolidation telecom and European technology companies.

To compete with the tech giants of the US and China, Europe needs strong leaders. In the Pallete model, Telefónica was a passive actor. On the defensive.

Financial discipline and plan focus Transform and growby reducing leverage to 2.5x, it seeks to restore the group’s maneuverability.

This is crucial, becauseOnly a healthy balance sheet and predictable cash management will allow Telefónica to be an active player and lead mergers and acquisitions that rebalance the continental market, something unthinkable with the inherited structure.

Telefónica’s Strategic Plan is a roadmap that can be summarized in one sentence: clean up to grow. Assume the reality of a weakened balance sheet and outline guidelines to achieve quality growth in the medium and long term.

Murtra did not deceive or try to deceive the market or opinion. The cold reaction of both and the punishment suffered by the action after its presentation will be temporary movements if the operator manages to put its strategic philosophy into practice and its success or failure will depend on this. And not only time will tell this, but also the first steps to implement it.

.