The Secretariat of Finance and Planning of the State of São Paulo (Sefaz-SP) published in an additional edition of the Official State Gazette (DOE), on December 12, the study commissioned from the Fundação Instituto de Pesquisas Econômicas (Fipe) containing the market values of vehicles that will serve as a basis for the launch of the Motor Vehicle Property Tax (IPVA) in 2026. Owners can now view the market value of the car for 2026. in Vehicles (Sivei), a simplified page on the Sefaz-SP website where you simply enter the vehicle’s license plate. In the coming weeks, IPVA 2026 will be available for payment on the banking network.

The Fipe survey covers 13,571 models and versions of vehicles, all brands combined. The study is based on retail prices in September/October 2025. Compared to the same period in 2024, market values show an average appreciation of 2.51%.

Total vehicle fleet and prices

The total fleet of the State of São Paulo is approximately 30.1 million vehicles. Of these, 19.2 million are subject to IPVA collection and 9.9 million are exempt because they were manufactured more than 20 years ago. Approximately one million people are considered exempt, immunized, or exempt from payment (such as taxi drivers, people with disabilities, churches, non-profit entities, official vehicles, and city buses/minibuses).

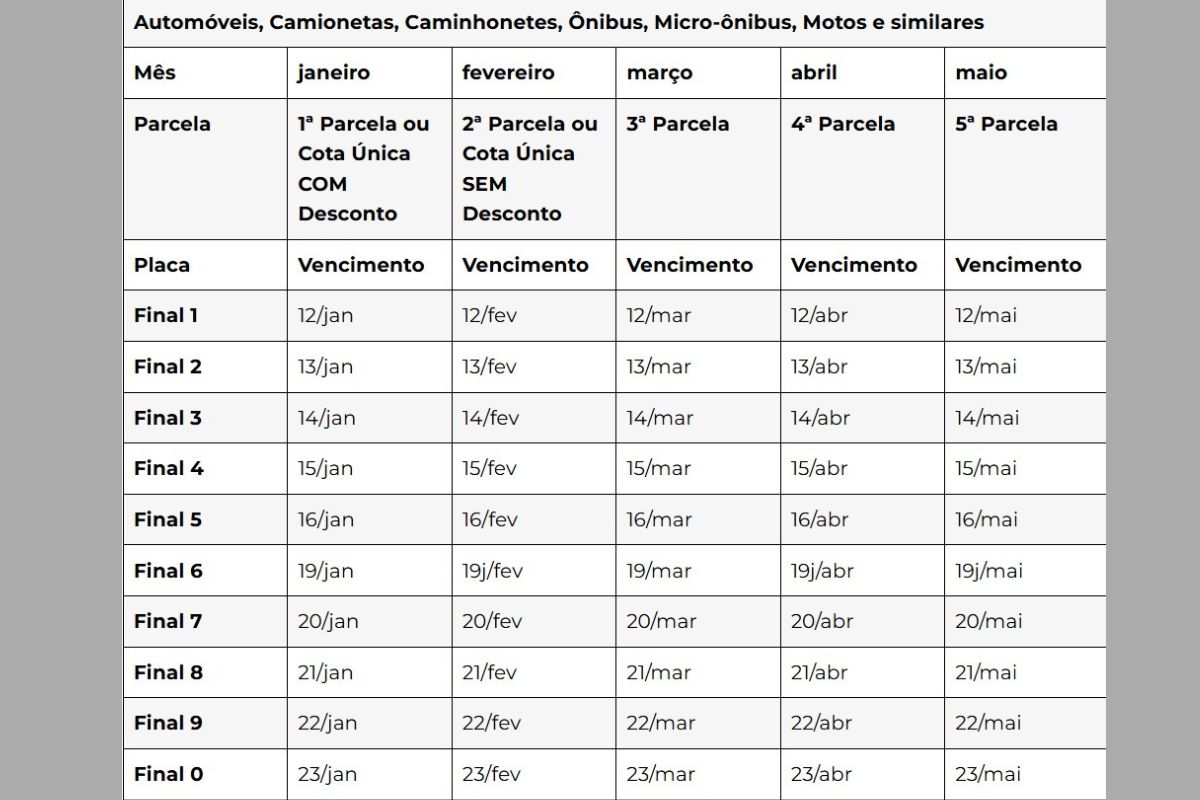

IPVA-2026 expiration schedule for automobiles

IPVA-2026 expiration schedule for automobiles

The amount collected from IPVA is endowed with constitutional allocations (such as Fundeb), with the remaining amount distributed half to the municipalities where the vehicles are registered, which must correspond to the place of domicile or residence of the respective owners, and the other half to the State. Fiscal resources are invested by the state government in infrastructure works and improving the delivery of public services such as health and education.

The tax rates for new and used private vehicles remain the same: 4% for private cars; 2% for motorcycles and similar vehicles, single-cab trucks, minibuses, buses and heavy machinery; in addition to 1.5% for trucks and 1% for vehicles from rental companies registered in São Paulo.

Read also

-

Sao Paulo

Lawyer condemns feminists for domestic violence: “Your fault”

-

Sao Paulo

“Christmas Flop”: the balloon parade in Minhocão frustrates the inhabitants of São Paulo

-

Sao Paulo

Fugitive after an operation, influencer Xuxa do Grau is arrested in SP

-

Sao Paulo

Husband tried to resuscitate woman who died after falling from 10th floor

What is new for 2026 is the SP Government’s proposal, sent to the Legislative Assembly for an emergency vote, which exempts from the payment of IPVA 2026 all motorcycles, mopeds and scooters with a cylinder capacity of less than 150 belonging to persons in regular registration and license status.

In 2026, the incentive remains for the use of vehicles using alternative and renewable energy sources in order to reduce polluting emissions and contribute to the improvement of the environment. The IPVA exemption applies to hydrogen vehicles and hybrid vehicles equipped with an electric motor and a flexible combustion engine powered by ethanol, worth up to R$250,000.

Buses or trucks powered exclusively by hydrogen or natural gas – including biomethane – will also benefit. The measure, in force since 2025, aims to stimulate investments in the production of vehicles powered by clean energy in the state of São Paulo, with a staggered annual exemption and, from 2027, there will be the application of increasing tariffs until the ceiling, in 2030 (see details here).

Payment schedule

Owners will be able to choose between the following payment methods with due dates based on the vehicle’s license plate number:

Preview

- Single quota in advance in January with a 3% discount;

- Single quota in February, no discount;

Deposit, without discount, according to minimum quota

- Up to 5 times, from January to May

Trucks have different deadlines: for full payment in January, a 3% discount is given; For those who choose to pay in one go, without discount, it is April 22. For homeowners who choose to pay in installments in three, four or five installments, with no discount, the due dates are March 20, May 20, July 20, August 20 and September 20.

IPVA-2026 expiration schedule for trucks

IPVA-2026 expiration schedule for trucks

Payment methods

To pay the 2026 IPVA, the taxpayer simply uses the approved banking network, with the RENAVAM number (National Register of Motor Vehicles).

In the state of São Paulo, Pix is the preferred payment method, because it is faster, simpler and confirmed immediately. By obtaining the QR code, generated exclusively on the Sefaz-SP website, payment can be made to more than 900 financial institutions, especially covering citizens with digital accounts who do not have accounts with major banks.

Traditional payment methods are retained. It is possible to make payment online, at self-service terminals or through other channels offered by the banking institution. It is also possible to pay at lottery points and with a credit card at companies accredited by Sefaz-SP.

Late payment

Taxpayers who do not pay the tax are subject to a fine of 0.33% per day late and late payment interest based on the Selic rate. Beyond 60 days, the percentage of the fine is set at 20% of the tax amount.

If the IPVA remains in default, the debt will be recorded in the Active Debt, in addition to the inclusion of the owner’s name in the State Cadin, preventing him from taking advantage of any credit he may have due to the request of the Nota Fiscal Paulista. From the moment the IPVA debt is recorded, the State Attorney General’s Office can collect it in the form of protest.

Failure to pay the IPVA prevents the vehicle license from being renewed. After the deadline set by Detran for obtaining the license, the vehicle may be seized, with a fine applied by the traffic authority and seven points on the national driving license (CNH).

All information about IPVA can be viewed on the IPVA page of the Sefaz-SP portal.