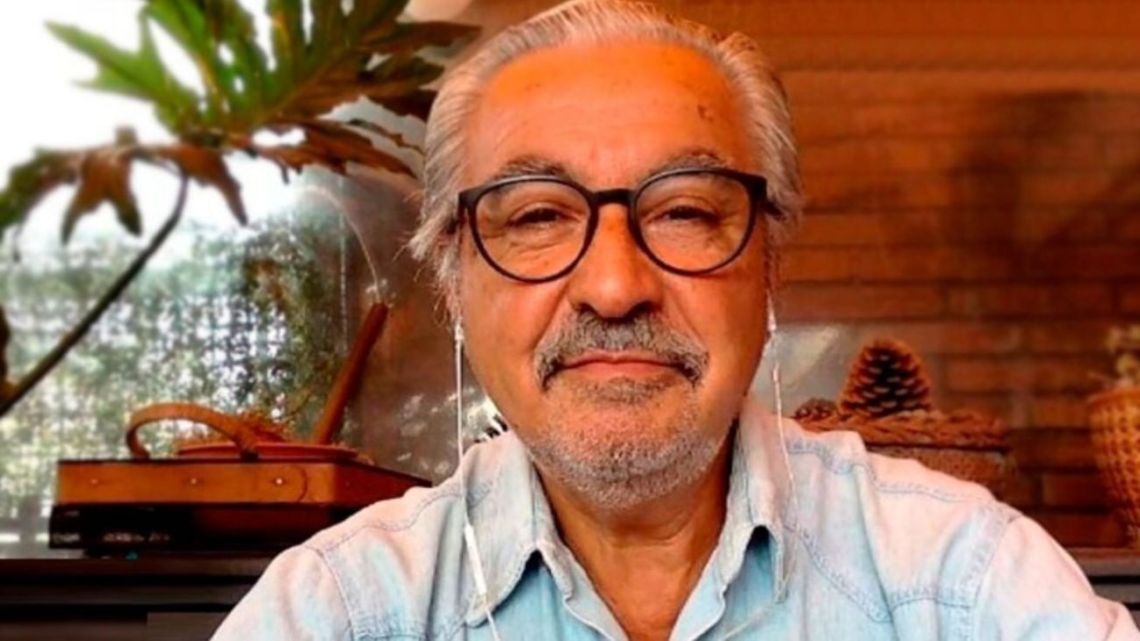

In dialogue with Channel E, Miguel Poncea foreign trade specialist, explained why the boom in artificial intelligence is raising fears of a new global financial bubble.

Economic history often repeats itself when euphoria triumphs over prudence. That’s what he warns about Ponce when analyzing markets’ growing enthusiasm for artificial intelligence (AI), a phenomenon dangerously reminiscent of the dot-com bubble of the late 1990s.

“It was not a story of failure but of excess: the market was paying in advance for a future that would take decades to come.” he noted, recalling the episode that left “a group” of investors defeated after the outbreak.

Ponce He explained that the current fear arises from concrete comparisons. “US stocks are just as expensive today as they were during the dot-com bubble” he explained, adding that the logic is similar: investors are betting that a new technology will trigger extraordinary profits.”If this growth occurs, the price is justified; but if it doesn’t arrive, adjustment will be inevitable“, he warned.

The lesson of the past and the mirror of AI

The specialist recalled the case of Cisco, the most valuable company in the world in 2000. “25 years later, the share price is back to the level it was back then“he suggested, emphasizing that the problem is not the technology, but the timing and size of the bet.”A stock can look expensive for many years if bought at the height of its euphoria“, he summarized.

Accordingly PonceSomething similar is happening today with artificial intelligence. “AI impresses everyone, but is still sold below its cost and causes losses for many companies“he explained. Although there is income, “They are not yet profitable for shareholders“, which fuels uncertainty. The parallels to the 1990s are clear: “People used to talk about the Internet before business models worked; Today the same thing is happening with AI“.

Record investments, winners and a key risk

One of the most sensitive points is the speed and volume of the investment. “We’re talking trillions of dollars in a very short period of time, partly funded by debt” he warned Ponce. This wave of spending, focused on data centers and chips, is already driving economic growth in countries like the United States. “The risk is not that artificial intelligence is useless, but that you have invested too much too soon.“, he remarked.

As with any technological revolution, there are clear winners. “The first to win are always the suppliers” he claimed, comparing yesterday’s Cisco to “Nvidia and today’s chip manufacturers“, whose revenues trigger stock market euphoria. However, there will also be losers: applications and companies that cannot hold their own in a scenario of high competition and rising costs.

The central question, closed Poncedefines the future of the market: “What matters is whether artificial intelligence brings the productivity and benefits that those trading in the stock market expect today.“If it doesn’t happen, the outcome will be similar to the dot-com bubble.”The important thing here is what can wait“, he explained.