- Tax transparency regime

He Ministry of Economic Affairs presented this Wednesday the portal of “Municipal tax transparency”a tool that allows citizens to obtain relevant information from a tax perspective.

The goal of this will be Strengthen tax transparency at the municipal level. This is why the wallet you carry with you Luis Caputo published the said portal with precise data regarding every single community in the country.

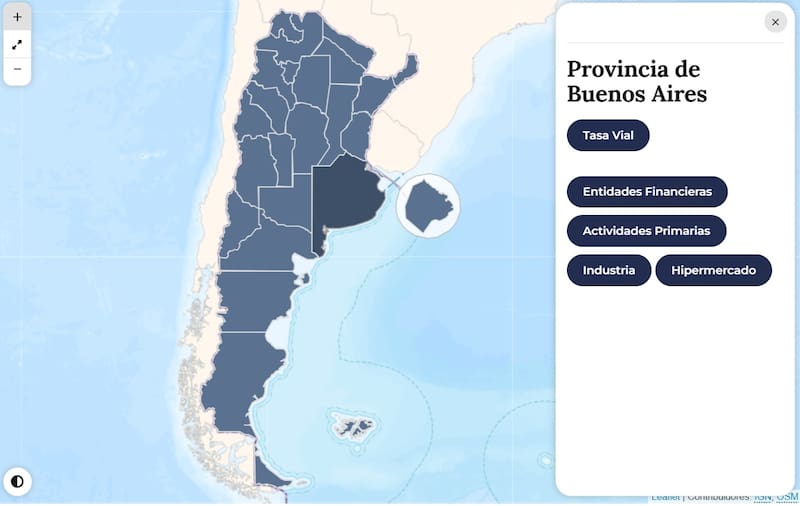

“In this context, a municipal tax map was created that makes it possible to identify relevant aspects, such as: Tax bases and tax rates that apply to selected tax ratesas well as carry out Comparisons between jurisdictionssaid Economy.

This is not just about promoting tax transparency, but also about “making it easier to analyze local tax systems.”

The map, accessible to all users, allows comparisons in different jurisdictions according to the following economic sectors: Financial companies, industrial, primary and consumer markets.

“This information has been prepared on the basis of the tax and tariff regulations approved without consideration at the beginning of the year any changes published later in the same period“, they clarified from the business community.

This fiscal transparency map will also be published as part of the Discussion between the nation and the provinces according to the amount of taxes levied by each jurisdiction.

“Information transparency is very important. This is part of what the national government is currently striving for,” commented the tax lawyer and CEO of SDC tax advisor, Sebastian Dominguez.

Although he highlighted that it was positive “that the fees they charge are transparent,” the truth is this Argentina’s more than 2,300 municipalities do not appear.

“There are municipalities that do not publish the municipal ordinance or the tariffs on their website. Accessing the data is difficult, but it is an important step forward so that people and companies can see what mayors are doing in any case“, he remarked.

In the case of the province of Buenos Aires, for example more than 100 communities appear. On this occasion, which is extended to the rest of the jurisdictions, “The data was collected on the official websites of the municipalities as of March 31, 2025.“.

Tax transparency regime

The government had already taken steps forward. The goal, in a sense, is to “force” the provinces and municipalities to show up. What taxes do taxpayers pay?.

He Tax transparency regimeThe proposal, passed in 2024 amid the debate over the base law, was a landmark proposal. “An initiative through which informs citizens truthfully and in detail about the tax portion that makes up the final value of their purchases“, they describe from the Customs Collection and Inspection Authority (ARCA).

The point is that the law include only national taxes. “All subjects carrying out sales, internships or the provision of services to final consumers must indicate in the publication of the prices of the relevant goods or services the final amount to be paid by the final consumer. In addition, they must indicate the net amount without taking into account value added tax (VAT) and other indirect national taxes that affect prices,” the regulations say.

However, the government invited the provinces and the Autonomous City of Buenos Aires (CABA). “to establish the relevant regulations in such a way that end consumers are aware of the impact of the gross income tax and the relevant local taxes that affect the pricing of goods, locations and the provision of services.”

Until now, only three provinces joined. As stated by logica non-profit civil association dedicated to tax awareness, Chubut, Mendoza and Entre Rios They are the only jurisdictions that have complied with the request.

Instead, Jump, Cordoba and CABA are in the accession process. “There are 18 governors who win the top medal“, ironically from Lógica through a post on Instagram.

We would like to get to know you!

Register for free at El Cronista for an experience tailored to you.