For people who want to exchange old or damaged banknotes, the monetary authority has introduced a major change

12/17/2025 – 7:48 p.m

:quality(75):max_bytes(102400)/https://assets.iprofesional.com/assets/jpg/2022/04/534549.jpg)

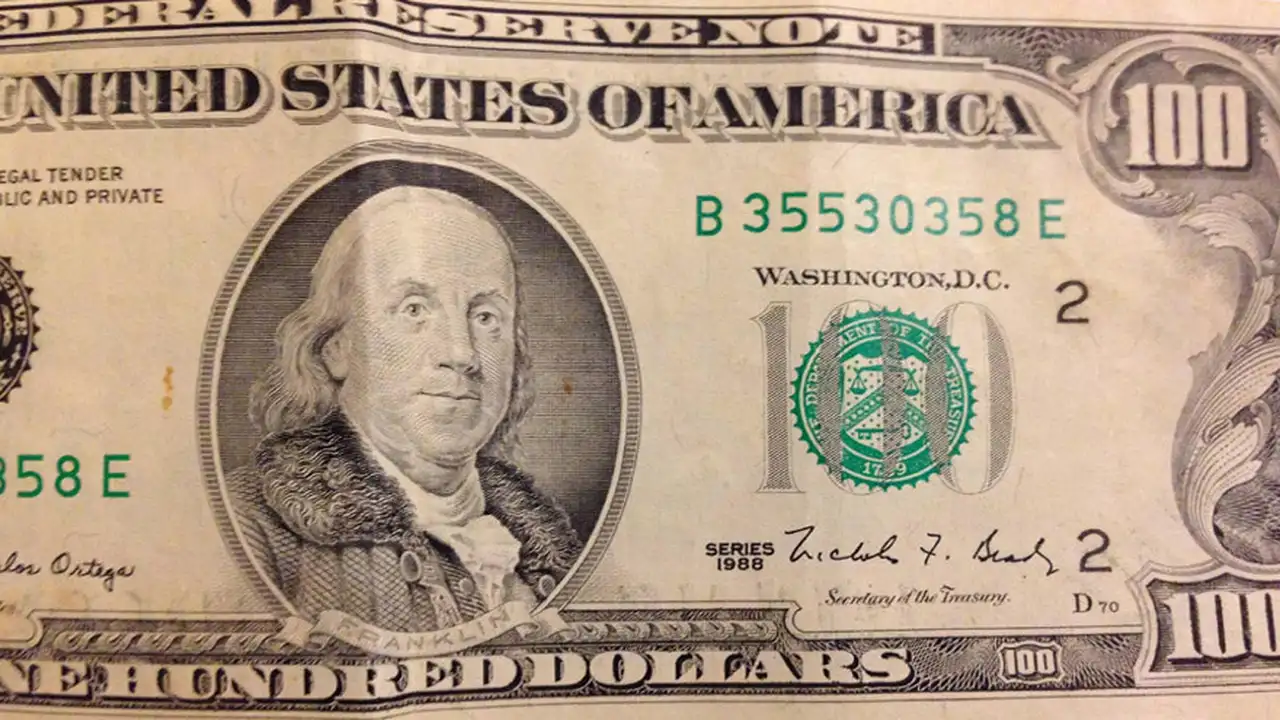

He Central Bank of the Argentine Republic (BCRA) Regulations allowing financial firms to do so have been extended indefinitely Receiving and exchanging declared US dollar billseven if they are in deteriorated condition, are of a format “little face” or existing stains. The measure enables customers Deposit these invoices in the banking systemwithout limitations due to physical wear and tear or old design.

The decision was announced by the Communication “A” 8352published in early November, which sets the deadline for the December 31, 2025 that was true until then. “We are writing to inform you that this institution has decided to suppress this Deadline according to Notice A 8205“whereby the provisions regarding the acceptance of deposits of US dollar bills under the established conditions remain in force,” the official text says.

How dollar exchange works on the “small side”.

The system implemented by the monetary authority makes this possible Argentine banks receive old dollar bills or those with visible deterioration and the Transfer to BCRA. These invoices will then be sent to United States for its destructionwhile new ones are imported as replacements.

In this process the Central Bank takes on an intermediary roleand is no longer limited to providing dollars. The service is free for financial institutions which participate and replace the operations that previously had to be carried out through private international banks, which implied additional costs.

The process for customers

If you want to exchange this type of banknotes, you must first Check whether your bank is a member of the program. If not, there are alternatives such as: National Bank and some provincial units participating.

Once membership is confirmed, tickets can be purchased Deposit at the bank counter. The review is limited to verification authenticity and to check whether they meet the requirements basic integrity criteria founded by the United States Federal Reserve. Exchanges will not be accepted if more than 40% of the invoice is unusable or missing.

After depositing, the customer can choose Keep money in a bank account either Withdraw them on banknotes of newer series. The conditions and deadlines depend on each company. The mechanism was adopted by the BCRA August last yearas part of initiatives to facilitate the Asset regulation. In this context, those who presented undeclared dollars had to include them in the Externalization programthat ended at November 8th.

The measure was also sought solve operational difficulties that public banks and local corporations had to manage the exchange of banknotes directly with the administration Federal Reserve. The program reduces costs and barriers for these institutions. The unlimited extension The aim is to expand access to spare parts, provided companies participate Volunteer. For this reason, it is advisable to consult the bank before presenting the banknotes.

In order to receive credit, invoices must be submitted more than 50% of its surface is preservedallow identification of the denomination and the Security measures. They must be counted piece by piece, checked for authenticity and presented straightened, corners and edges aligned. Notes that are not suitable due to their physical nature must be included in the regular deposit.

Finally, they don’t accept it Hundreds contain sub-hundredsE.g. rubber bands or clips. The bills identified as mutilated They will not be accepted and should not be included in eligible or non-eligible tickets.