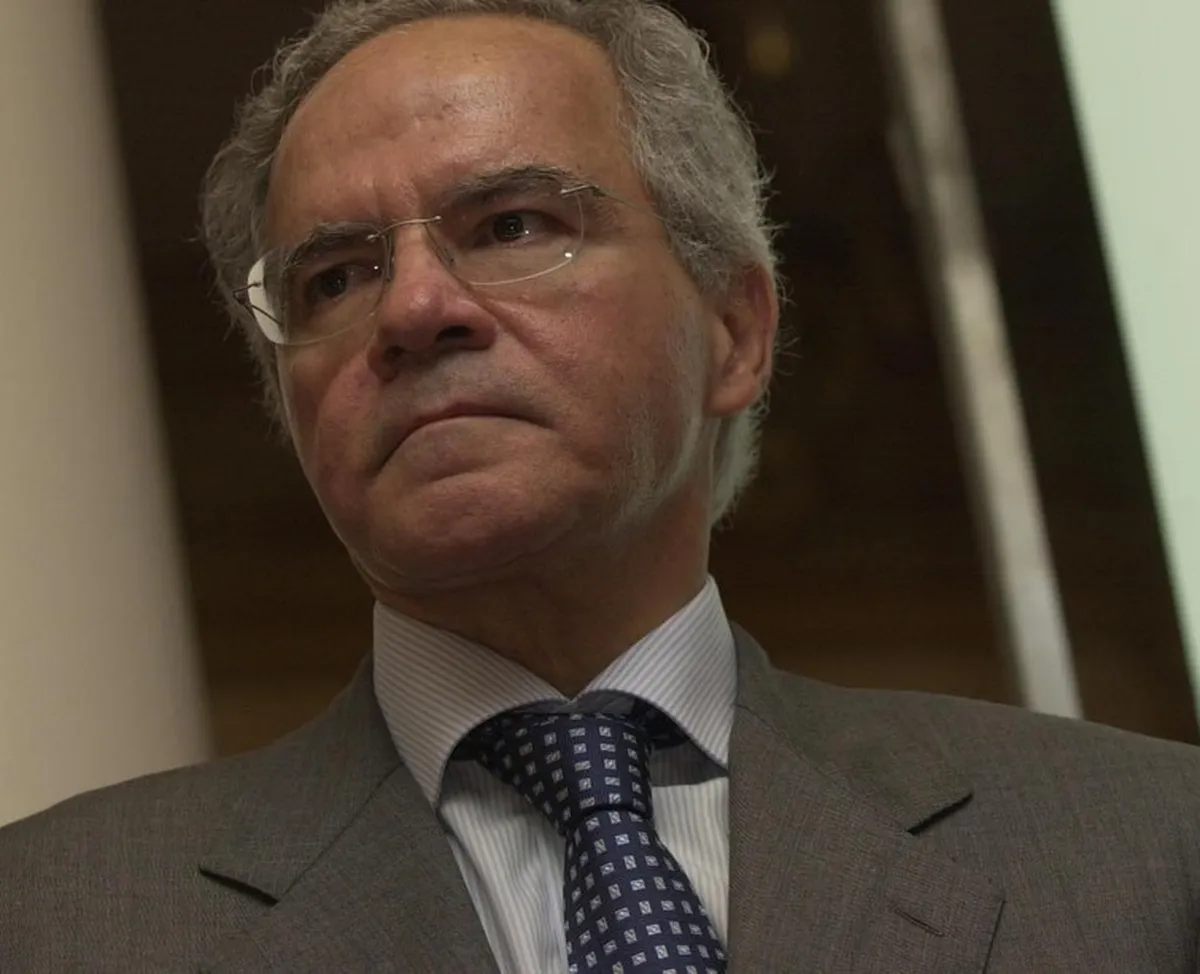

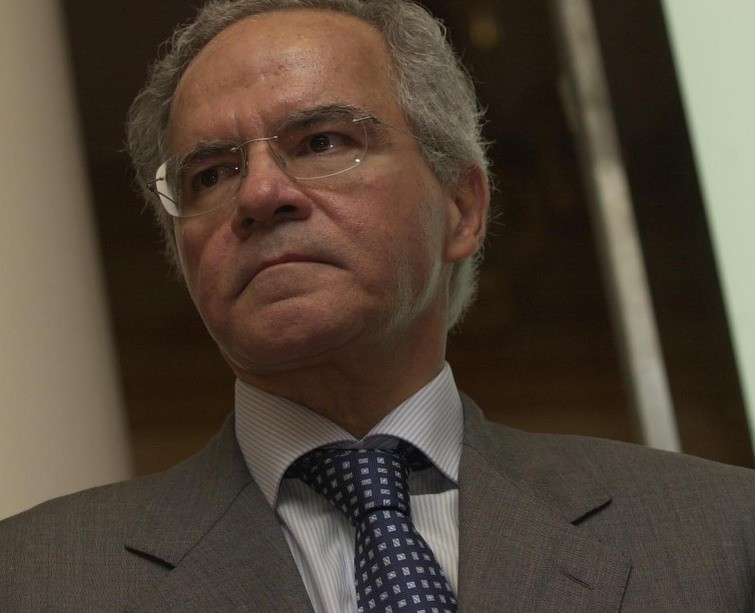

THE MPF (Federal Public Ministry) reported this week Nelson Tanure accused of having used confidential information in the context construction company Gafisa. The matter remains under investigation at the CVM (Securities Commission), but according to investigators, there is evidence of materiality and sufficient evidence of authorship to file the complaint. The businessman highlighted links with the case of Main bank and requested that the matter be referred to the STF (Federal Supreme Court).

View results and metrics Gafisa, B3 and other publicly traded companies on the Valor Empresas 360 portal

According to the petition filed with the 9th Federal Criminal Court of São Paulo, Tanure and the businessman Gilberto Benevides exercised insider trading in the acquisition transaction Upcon Developer for the Gafisawhich took place between 2019 and 2020. They allegedly carried out a series of financial moves to inflate Upcon’s market value and, as a result, receive more voting shares of the construction company in the buy-and-sell transaction.

In a statement, Tanure’s defense said the businessman has decades of professional experience in the securities market and has never been accused of criminal practices in companies in which he is or was a shareholder. Lawyer Pablo Naves Testoni said Tanure “regrets the rushed complaint filed by the Federal Public Prosecutor’s Office and is certain that the facts will be clarified in the process.” Benevides declined to comment.

At the time reported by the complaint, Tanure was a relevant shareholder of Gafisa and member of the board of directorso, whose mandate began in April 2019. Benevides, meanwhile, was the majority shareholder of Upcon and directly responsible for the negotiations.

According to the prosecution, Tanure used corporate structures with two offshore companies based in tax havens and the Singular Plus investment fund with the aim of concealing their participation in the Gafisa and conducting covert operations with Upcon.

Prosecutors traced an affair that took place days before the purchase was finalized, in February 2020. At the time, Upcon benefited from a sudden 150 million reais increase in its share capital and increased its market value by almost 1,400%.

The market value of Upcon was important to the transaction because it would determine the amount of shares to be transferred from Gafisa to Upcon’s controllers. In this case, Gafisa did not use cash resources and carried out the purchase with transfer of shares.

According to surveys, Tanure and Benevides, knowing that Upcon’s valuation report would be prepared in a few days, contributed money to the promoter’s share capital to inflate the market value and increase the size of shares to be paid by Gafisa.

To integrate the values into the share capital, Benevides obtained a loan from Brokerage of planners. According to the investigation, the money lent actually came from Tanure, which used the Singular Plus investment fund to internalize the guarantees given into the company.

With this operation, according to the complaint, the businessman became the holder of credit rights to the Gafisa shares that would be issued to buy Upcon. In this way, he could expand his power in the construction company and exert influence over the decisions of Benevides, who was entitled to a place on the company’s board of directors.

The indirect purchase of shares of Gafisa was still achieved with a value 12% lower than that negotiated in B3. The case ended up being exposed on the market due to the amounts moved and the existence of specific funds acting as intermediary structures. The MPF claims that everything happened without the knowledge of other Gafisa shareholders.

For Tanure’s lawyers, the accusation falls outside the scope of the rules governing criminal procedure because: the CVM has not yet identified the illegality of the operation; the federal police, who investigated the same facts, found no evidence of a crime; and the Upcon acquisition transaction was widely discussed in Gafisa, with the publication of relevant facts before and after the conclusion of the transaction, with the approval of the majority of shareholders and the construction company itself.

The prosecutor’s office called for urgency in analyzing the case, because those involved are over 70 years old and the statute of limitations has half expired. According to the law, the maximum sentence for crimes like this is 5 years and the statute of limitations is 12 years. With a halving, the prescription will take place in February next year.

Quotation from Banco Master and submission to the STF

Shortly after the publication of the complaint, Tanure’s defense requested that the proceedings be referred to the STF (Federal Supreme Court). In the complaint, the MPF mentions the proximity between Tanure and Banco Master, liquidated by Central bank and is the central target of investigations carried out by the Operation Zero Compliancewhich deals with fraud committed against the financial market.

The Master, although not denounced in the Gafisa case, is cited in the complaint as a financial and operational arm that allowed the necessary concentration of shareholders to inflate assets and provide guarantees for Tanure’s operations in the market, creating a scenario of manipulated liquidity.

As the captain’s investigations continue at the STF, as determined by the Minister Dias ToffoliTanure’s defense argued that the complaint in the Gafisa case should be afforded the same confidentiality. Regarding the request to be sent to the STF, lawyer Pablo Naves Testoni refused to comment.